10+ Student Budget Samples

It’s critical to understand how to manage your money when you begin your college adventure, in addition to juggling school and job. You can be in for some nasty shocks at the end of the semester if you don’t plan beforehand. Budgeting for college students is very crucial in this regard. Budgeting is critical for your financial security as a student, ensuring that you can pay for necessities such as rent, tuition, student loans, credit card payments, and leisure. If you need some help with managing your budget as a student, look no further! In this article, we provide you with free and ready-to-use samples of Student Budgets in PDF and DOC formats that you could use as a student. Keep on reading to find out more!

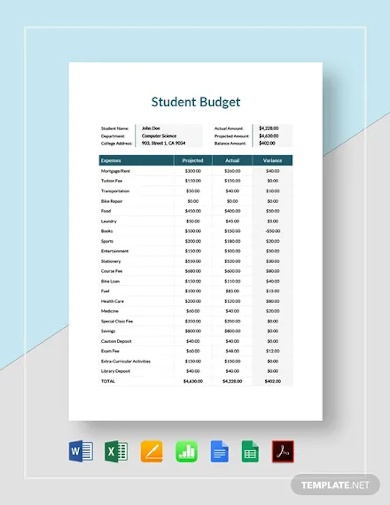

1. Student Budget Template

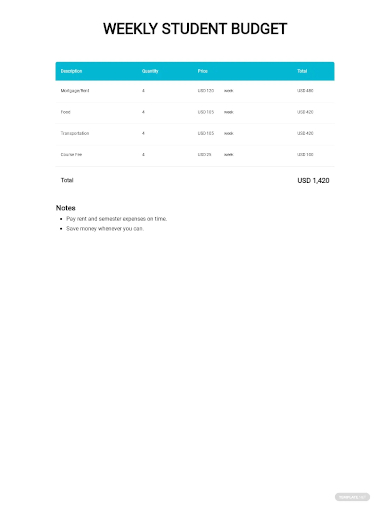

2. Weekly Student Budget Template

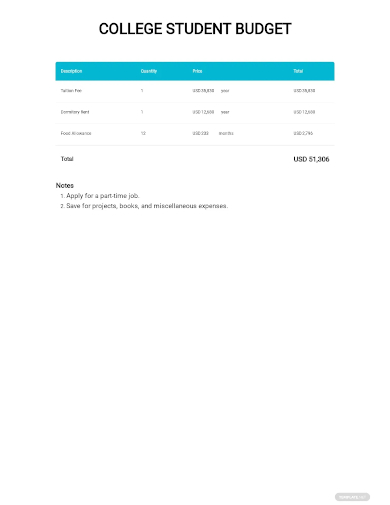

3. College Student Budget Template

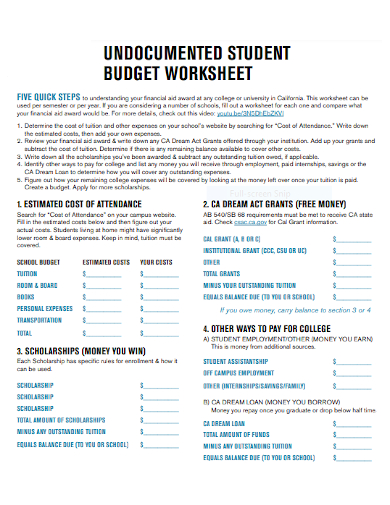

4. Undocumented Student Budget Worksheet

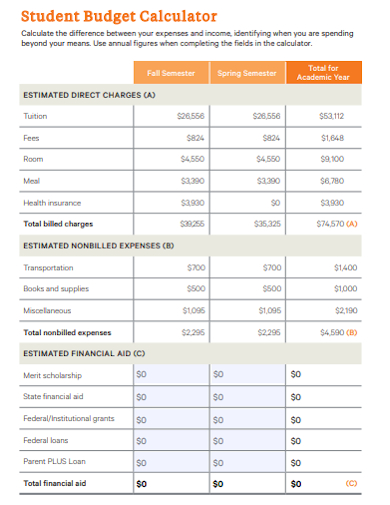

5. Student Budget Calculator

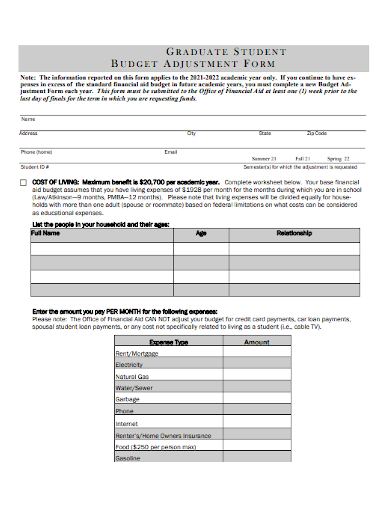

6. Graduate Student Budget Adjustment Form

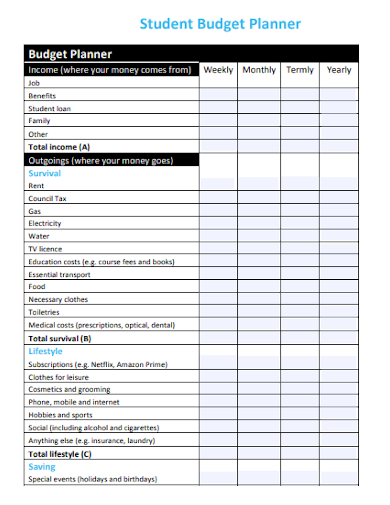

7. Student Budget Planner

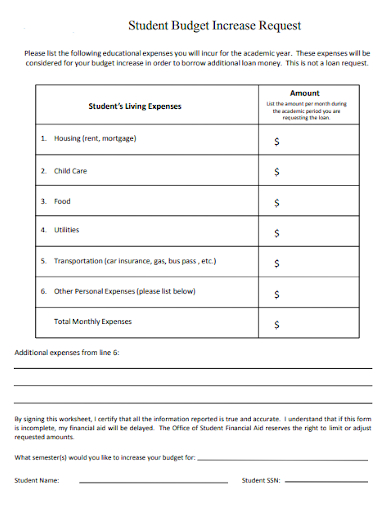

8. Student Budget Increase Request

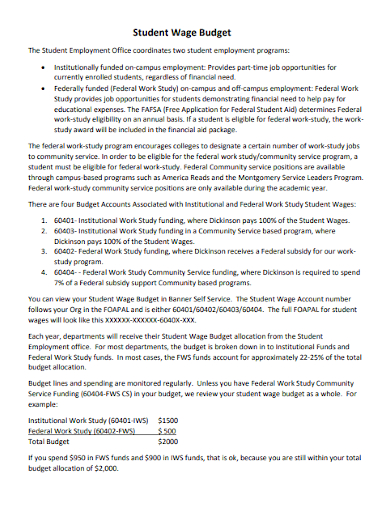

9. Student Wage Budget

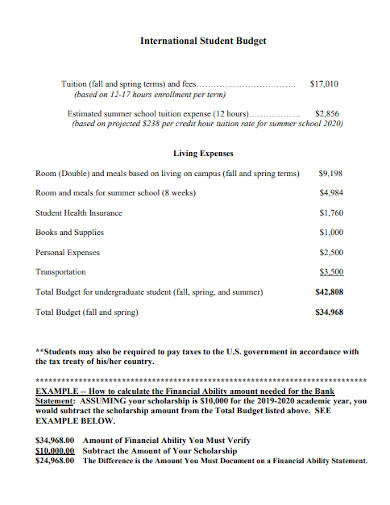

10. International Student Budget

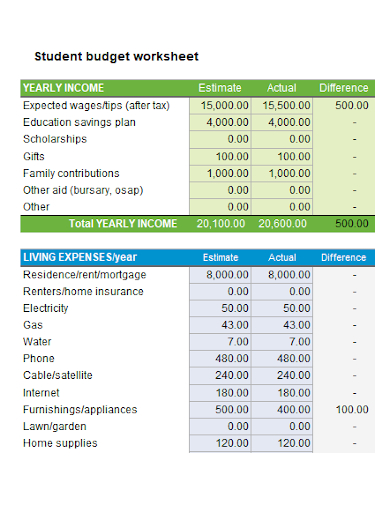

11. Student Budget Worksheets

What Is a Student Budget?

It’s critical to understand how to manage your money when you begin your college adventure, in addition to juggling school and job. You can be in for some nasty shocks at the end of the semester if you don’t plan beforehand. Budgeting for college students is very crucial in this regard. Budgeting aids students in debt management by promoting prudent financial planning and spending decisions. Learners may use budgeting to discover and minimize needless expenditure that might otherwise go unnoticed. An efficient college student budget also accounts for money for future plans and crises, preventing students from accumulating loans or credit card debt in the case of these occurrences.

How to Make a Student Budget

College is frequently too expensive. However, careful school selection and budgeting strategies may assist students in budgeting for college and planning for the future. A Student Budget Template can help provide you with the framework you need to ensure that you have a well-prepared and robust budget on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these strategies below to guide you:

1. Gather your financial information.

Before you can begin budgeting properly, you must first determine how much money you have available each semester.

2. Budgeting for college expenditures.

Your day-to-day costs may not be too high while you’re at college. However, when you include in school-related costs, your college student budget suddenly has to support a lot more.

3. Take use of public transportation.

Due to the high cost of petrol, commuter students frequently save money by taking the bus, trolley, metro, or train to school. Commuting costs can also be reduced by living near campus.

4. Make the most of the campus amenities.

Many institutions provide complimentary services such as health clinic visits, counseling, career planning, and campus leisure. Instead of paying for identical services off campus, students can save money by accessing these free on-campus programs.

5. Get a part-time job or start a side business.

Many students rely on part-time employment or side companies to help pay for their education. For many students, balancing a full-time job with full-time school may be too difficult.

FAQ

What is the point of having a budget?

A budget is basically a spending plan that takes current and future income and costs into consideration.

What is the 50-30-20 rule in terms of budgeting?

The 50/30/20 rule is a simple budgeting approach that can assist you in successfully, easily, and sustainably managing your money. The general idea is to divide your monthly after-tax income into three spending categories: 50% for necessities, 30% for desires, and 20% for savings or debt repayment.

Making a budget with your adolescent is a terrific approach to teach them valuable life skills like financial literacy. Teen budgeting may assist them in establishing financial priorities for the things that important to them and determining which items they can live without. To help you get started, download our easily customizable and comprehensive samples of Student Budgets today!

Related Posts

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Personal Budget Planner Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Numbers | Apple Pages | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF