Creating a business budget plan allows you to determine if your business has enough money to do the projects you want to build. By planning how to spend your money, you can make sure that you always have enough money for the tasks or things you need to complete or purchase. Budgeting is a part of financial management that can keep you out of debt or enable you to work out of one if you have debt.

10+ Zero Budget Samples

1. Zero Budget Research Report

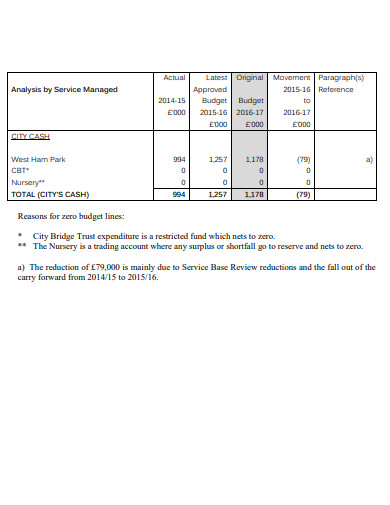

2. Zero Budget Lines

4. Zero Base and Performance Budget

5. Net Zero Wales Carbon Budget

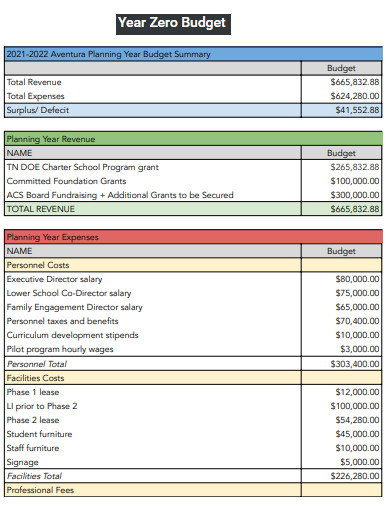

6. Year Zero Budget

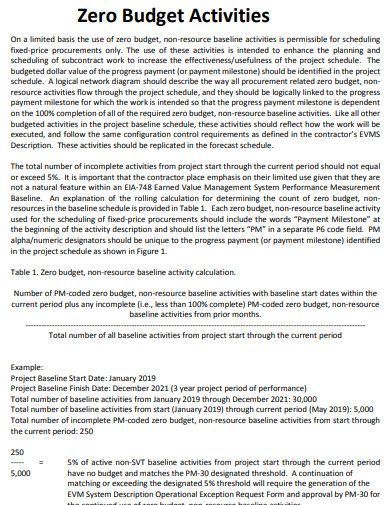

7. Zero Budget Activities

8. Zero Budget Entrepreneurship

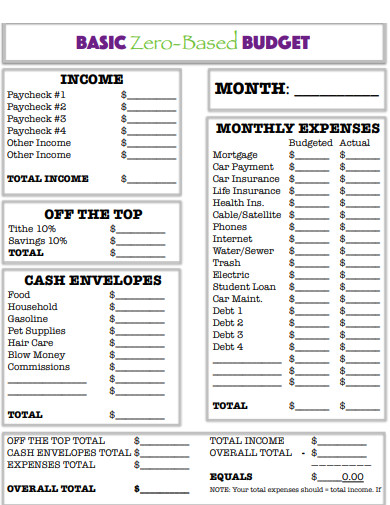

9. Basic Zero Budget

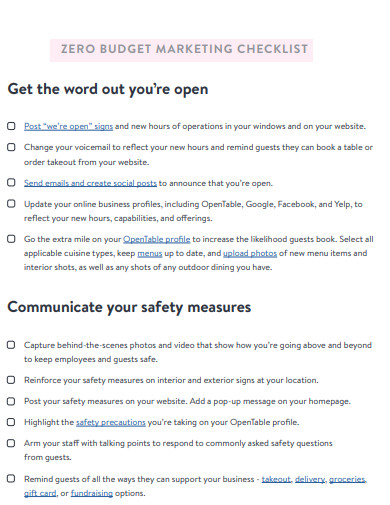

10. Zero Budget Marketing Checklist

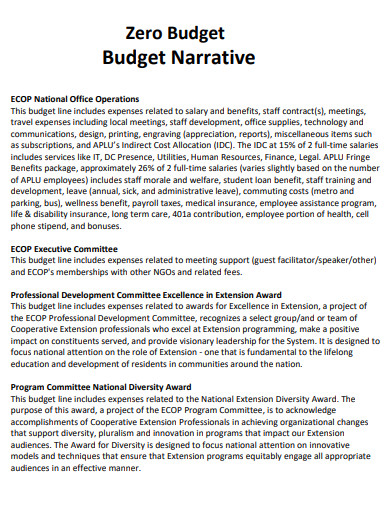

11. Zero Budget Narrative

What is a Zero Budget Template?

Zero budget or zero-based budgeting is a method used where all your money is allocated for your expenses like wants and needs as well as for your long and short-term savings and paying for debts. This budgeting plan aims to get you a total of zero as your income is used for your expenditures. This plan can be used for any type of cost like capital expenditures, operating budget and expenses, sales, general, and administrative costs, marketing budget or costs, variable distribution, or cost of goods sold.

How to Make a Zero Budget?

A zero-based budget is a strategic planning of how to efficiently use every coin you get for your monthly income. This method aims to give every penny you receive a purpose, which enables you to intelligently spend your money on the things that matter the most. It can be used by various companies but can also be used by individuals. Zero-based budgeting is also effective as a tool for business planning which enables companies to identify and eliminate costs, control their spending, and pay more attention to high-gaining projects.

Step 1: Create a List of Your Monthly Income

You can list your monthly income on a piece of paper or on a mobile application of your choosing. Your income can include your regular payments as well as other plans to bring in during the month like side hustles or child support. Add them all and the total will be your monthly income.

Step 2: List Down Your Expenses

List all the things you’ll need to spend your money on such as giving, savings, the top bills you have to cover like food, utilities, rent, and transportation, other essentials like insurance, childcare, or debt, extra expenses such as entertainment and restaurants, and month-specific expenses like holidays and celebrations.

Step 3: Calculate the Difference Between Your Income and Expenses to Equal Zero

Subtract all your expenses from your monthly income. It must be equal to zero. If does not, it is completely fine and normal. The majority of people who uses the same method also have the same result. You can use the extra money to pay off debt or save it.

Step 4: Track Your Expenses During the Entire Month

Tracking how you spend your money the entire month helps you determine if you are efficiently spending your money. Make a new budget before the next month begins so you can be ahead of time and prepared.

FAQs

What is the difference between traditional budgeting and zero-based budgeting?

Traditional budgeting tends to call for gradual increases over the previous budgets and only analyzes the new expenditures while zero-based budgeting aims to justify expenditures and aims to deliver value for a company by optimizing not only the revenue but also the costs.

What are the benefits of using the zero budgeting method?

With zero budgeting, it can help you align your spending to more opportunities that generate revenues. It also helps in lowering costs, provides budget flexibility, and strategic planning and execution. As you carefully consider how to spend each penny, zero budgeting enables you to prioritize activities that generate the highest revenue.

What are the best practices for zero budgeting?

The best practices for zero budgeting include adopting a strategic approach that helps you identify overspending., selecting the appropriate planning platforms that include cloud-based planning solutions with the use of AI and machine learning, and embracing connected planning across the organization.

Zero budget templates are documents used by both businesses and individuals for more efficient cost management and account management. Zero budgeting is a method that allows a company to identify cost savings, reposition them for a more useful strategy, and drive sustainable growth while also generating revenue. As a company’s strategic plan for more effective budgeting, zero-based budgeting also allows them to track its expenses and adjust them so the company can still achieve its business goals.

Related Posts

FREE 10+ Personal Budget Planner Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Numbers | Apple Pages | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages