In the modern financial ecosystem, the ‘ACH Form’ has become indispensable. Facilitating electronic money transfers through the Automated Clearing House (ACH) network, this professional form ensures seamless and secure transactions between banks. Whether it’s for recurring bill payments, direct deposits, or business-to-business transactions, a comprehensive ACH Form guarantees accuracy and protection. Dive into our guide to explore its nuances, design, and the pivotal role it plays in today’s digital banking landscape.

17+ ACH Form Samples

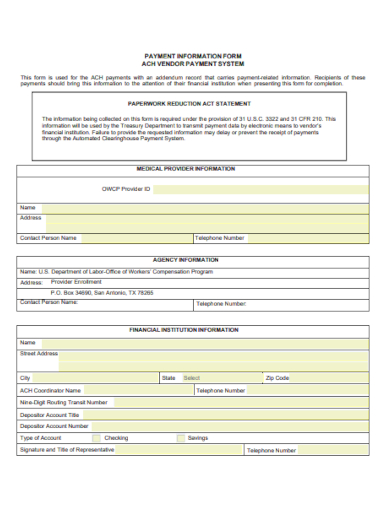

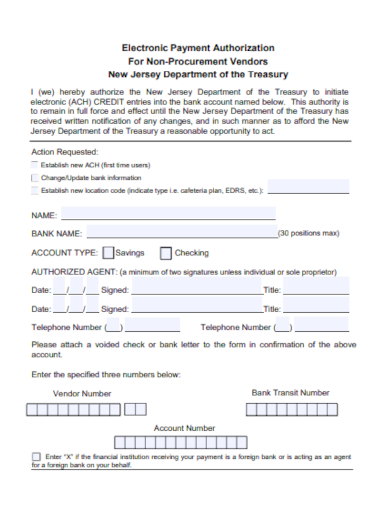

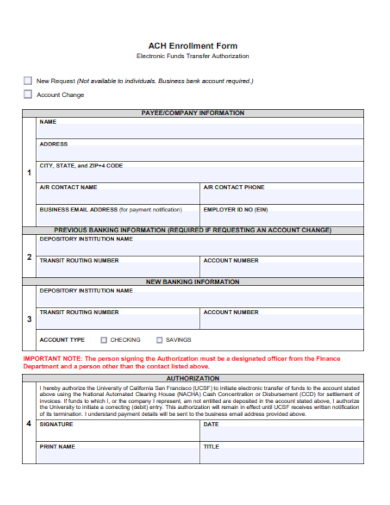

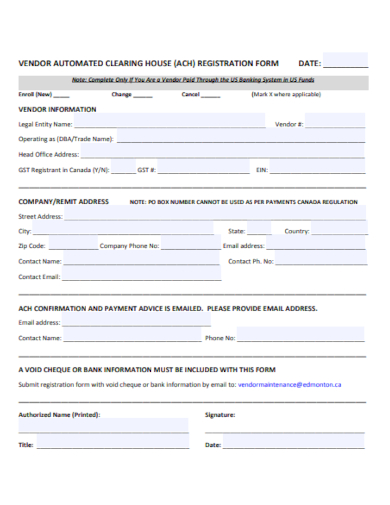

1. Sample ACH Vendor Form Template

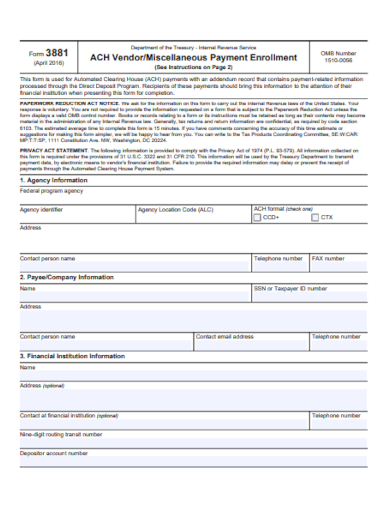

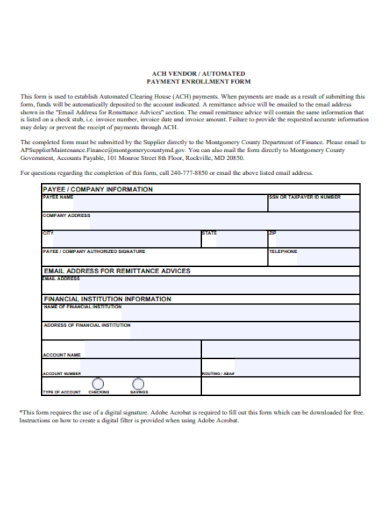

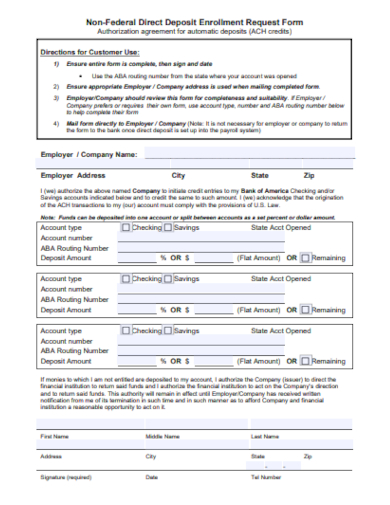

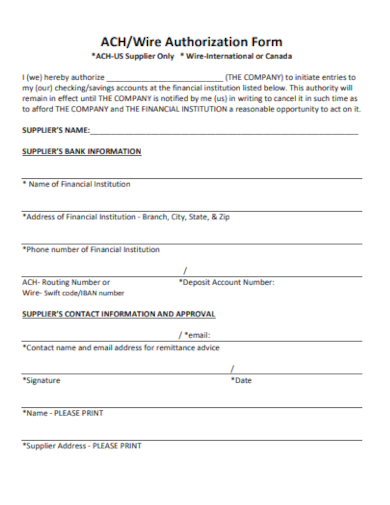

2. Sample ACH Request Form

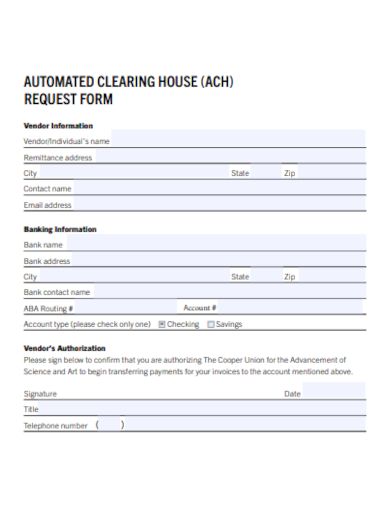

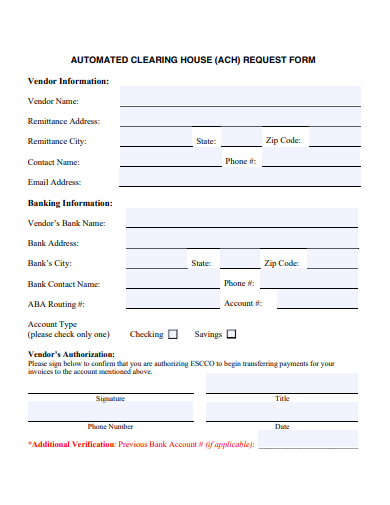

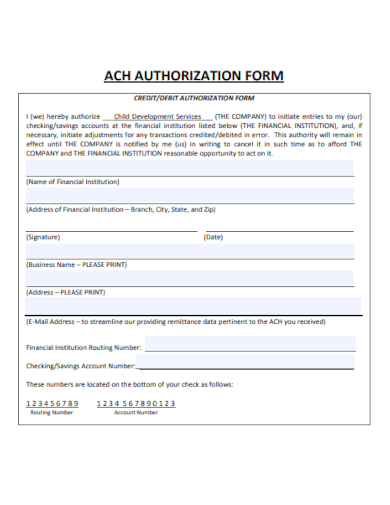

3. Sample ACH Direct Payment Form

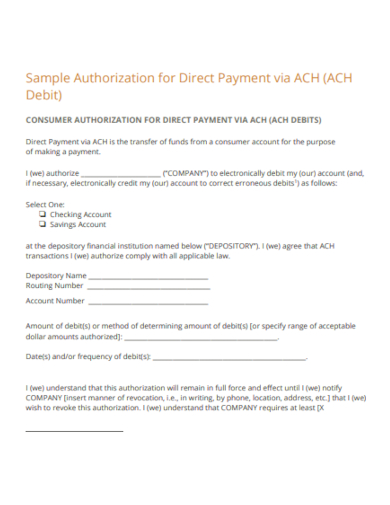

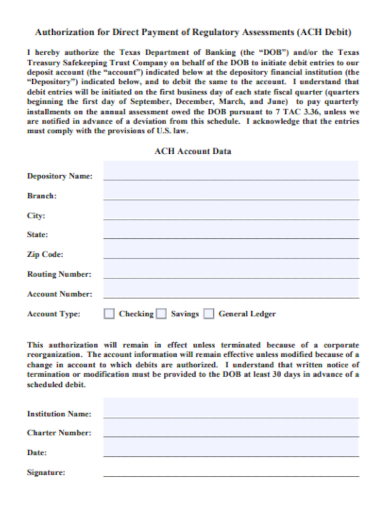

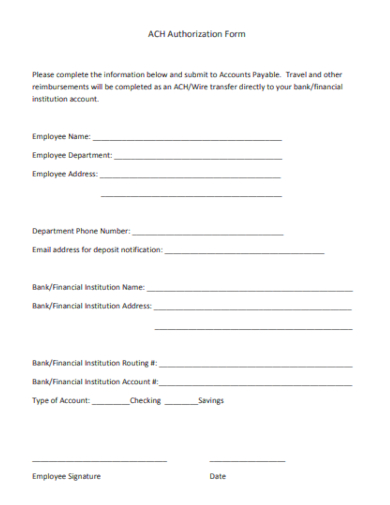

4. Sample Authorization for ACH Form

5. Sample ACH Form Template

6. Sample Fillable ACH Form Template

What is ACH Form?

An ACH (Automated Clearing House) form is a document that an individual or entity uses to grant permission for money to be electronically transferred to or from their bank account. The ACH network facilitates a vast volume of electronic transactions in the U.S., including direct deposit of paychecks, automatic bill payments, and transfers between bank accounts. You can also see more templates like Payment Authorization Form Samples.

The Importance of ACH Forms

ACH forms serve a pivotal role in ensuring safe and secure electronic transactions. They act as proof that a customer has given their consent to a specific transaction, making them vital for both businesses and individuals.

Components of an ACH Form

- Authorization Type: This section denotes whether the customer is giving permission for a one-time transaction or recurring transactions.

- Personal Information: This typically includes the customer’s name, address, and contact information.

- Banking Details: Here, the customer provides details about their bank account, including the account number and the bank’s routing number.

- Transaction Details: Information about the transaction, such as the amount to be debited or credited and the date of the transaction.

- Signature: This is where the customer signs, confirming they’ve given permission for the transaction.

Types of ACH Transactions:

- ACH Debit: Money is taken out of an individual’s bank account. For example, when setting up an automatic bill payment.

- ACH Credit: Money is deposited into an individual’s account, such as when receiving a direct deposit paycheck.

The Difference Between ACH Debit and ACH Credit

- ACH Debit: This is when funds are taken from an account. For example, when an individual sets up an automatic monthly payment for their electricity bill.

- ACH Credit: This refers to funds being deposited into an account. Examples include when an employer deposits an employee’s salary directly into their bank account.

The History of ACH Transactions

The Automated Clearing House network, under the operation of the National Automated Clearing House Association (NACHA), has been facilitating electronic funds transfers for decades. Originating in the 1970s, ACH sought to reduce the reliance on sample paper checks, offering a more efficient and faster method for transactions.

Understanding ACH Return Codes

When processing ACH transactions, there are times when an error might occur, leading to the transaction not being completed. Each type of error has a specific ‘return code’ associated with it. Some common return codes include:

- R01: Insufficient Funds – The available balance is not enough to cover the transaction.

- R02: Account Closed – The bank account specified is no longer active.

- R03: No Account/Unable to Locate Account – The account number provided does not match any account for the given routing number.

Understanding these codes can help businesses and individuals troubleshoot transaction issues quickly. You can also see more templates like Contact Information Forms.

Safety Protocols in ACH Transactions

While ACH transactions offer enhanced efficiency, ensuring the safety of these electronic transfers is paramount. Some safety protocols include:

- Encryption: Ensuring that transaction details are encrypted helps protect sensitive information from potential threats.

- Two-Factor Authentication (2FA): Many ACH providers now offer 2FA, where users must verify their identity in two distinct ways before accessing accounts or approving transactions.

- Regular Audits: Regularly auditing transaction histories can help identify and address any discrepancies or unauthorized transactions quickly.

Advantages of Using ACH Forms

- Convenience: Automatic transactions mean individuals don’t need to remember due dates or manually transfer funds.

- Cost-Effective: Electronic transfers can be cheaper than processing checks, saving businesses money in the long run.

- Security: With the right protocols in place, ACH transactions can be more secure than many traditional methods of payment.

Setting Up ACH Transactions: A Step-by-Step Guide

- Choose an ACH Provider: Businesses first need to select a provider that can facilitate ACH transactions.

- Get Customer Consent: This is where the ACH form comes into play. Before any transaction can occur, the customer must fill out and sign an ACH sample form.

- Enter Transaction Details: Once consent has been given, the business can set up the transaction details within their ACH provider’s system.

- Monitor the Transaction: It’s important for businesses to keep an eye on transactions to ensure they go through successfully.

How to fill out an ACH Form?

Filling out an ACH form is a straightforward process. Here’s a step-by-step guide:

1. Personal or Company Information:

- Full Name: If it’s for an individual, write your full legal name. If it’s for a company, provide the company’s legal name.

- Address: Provide your current address or the company’s address.

- Contact Information: Often, this includes a phone number and email address.

2. Banking Details:

- Bank Name: Write the name of your bank or the bank where the account is held.

- Type of Account: Check the appropriate box or specify if the account is a checking or savings account.

- Routing Number: This is a nine-digit number that identifies your bank. It can usually be found on the bottom left of your checks or through online banking.

- Account Number: This is your specific bank account number. It’s located at the bottom of your checks, next to the routing number, or through online banking.

3. Transaction Information (if applicable):

- Frequency: Indicate if the transaction will be one-time or recurring (e.g., weekly, monthly).

- Amount: If you know the amount that will be transacted, specify it. Sometimes, this might be left blank if the amount can vary.

- Start and End Date: For recurring transactions, you might need to specify when the transactions should start and end.

4. Authorization Statement:

- Read carefully. This is where you’re giving permission for the ACH transactions to occur. Ensure you understand the terms.

5. Signature and Date:

- Sign and date the form. This is crucial as it’s your formal authorization for the transactions.

- Some forms might require a witness or notary, so ensure you check for any such requirements.

6. Additional Documentation: Some ACH forms may require you to attach a voided check. This provides additional verification of your bank account and routing numbers.

7. Review: Before submitting, double-check all the information for accuracy. Ensure there are no typos or mistakes, especially in the account numbers.

8. Submission: Follow the instructions on where and how to submit the form. It might be to a company’s payroll department, a service provider, or another entity.

9. Store a Copy: It’s good practice to keep a copy of the completed form for your records.

Always ensure you’re providing this information to a trustworthy source, as ACH forms contain sensitive banking details. If in doubt, verify the legitimacy of the request before completing any form. You can also see more templates like Distribution Form Samples.

How do I get an ACH Form?

Obtaining an ACH form typically depends on the specific need or context in which you intend to use it. Here’s a general guide on how to get one:

- Your Bank or Financial Institution: Most banks provide ACH forms, especially if you intend to set up transfers between different banks or accounts. Visit your bank’s local branch, or check their online portal. Some have downloadable PDFs available on their websites.

- Employers: If you’re setting up direct deposit for your paycheck, your employer’s HR or payroll department will typically provide the necessary ACH or direct deposit form.

- Service Providers and Billers: If you’re setting up automatic bill payments, the service provider (e.g., utility company, mortgage lender, or insurance company) will often provide an ACH authorization form either on their website or upon request.

- Online Templates: There are many websites that offer generic ACH form templates. If you decide to use an online template, make sure it’s comprehensive and suits your specific needs. You might want to consult with a legal or financial professional to ensure it’s appropriate.

- Financial Software or Platforms: Some financial sample management software or platforms, especially those catering to businesses, may offer integrated ACH form generation or templates.

- Accountants or Financial Advisors: If you’re working with a financial professional, they often have access to or can provide you with appropriate forms for various financial transactions, including ACH authorizations.

Once you obtain the form, make sure to fill it out accurately and securely. Remember, this document will have sensitive banking information, so ensure it’s handled with care and only shared with trusted entities. If ever in doubt about the authenticity of an ACH form request, always verify with the requesting party or consult with a professional.

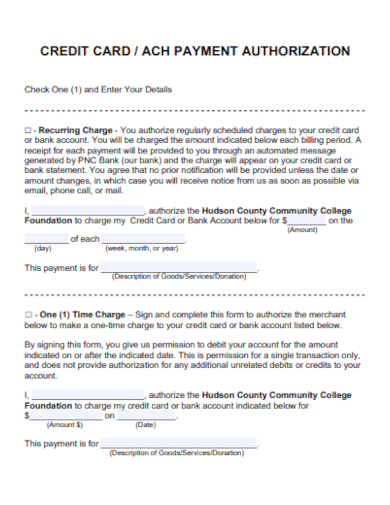

7. Sample Credit Card ACH Form Template

8. Sample Electronic Payment ACH Form Template

9. Sample Direct Deposit ACH Form Template

10. Sample Banking ACH Form Template

11. Sample Employee ACH Form Template

12. Sample Editable ACH Form Template

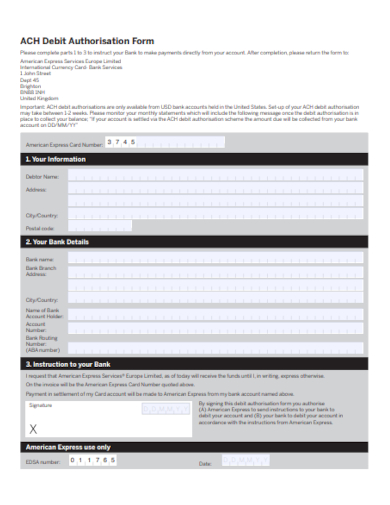

13. Sample ACH Debit Authorization Form Template

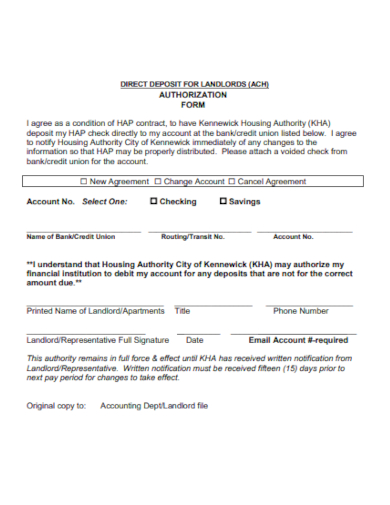

14. Sample Landlord ACH Form Template

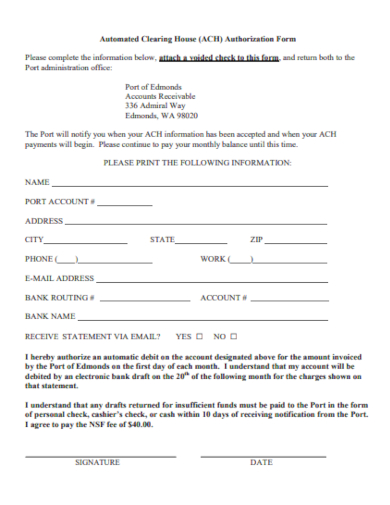

15. Sample Automated Clearing House Form

16. Sample ACH Wire Transfer Form Template

17. Basic ACH Registration Form Template

18. Sample Standard ACH Form Template

How do you Create a ACH Form?

The Automated Clearing House (ACH) network facilitates electronic money transfers between banks. When you need to set up recurring payments, direct deposits, or electronic funds transfers, you’ll often be required to complete an ACH sample authorization form. This form grants permission to a business to deposit or withdraw funds from an individual’s or another business’s bank account.

Here’s how you can create an ACH

Step 1: Define Transaction Type

Start by specifying the nature of the ACH transaction. Are you setting up for a debit, where you’ll be taking money out of an account, or a credit, where you’ll be depositing money into an account? Understanding and defining this upfront will guide the entire process and the form’s sample outline.

Step 2: Gather Essential Data

Compile all necessary information for the transaction. This includes personal or business details such as the account holder’s full name, address, and contact number. For the banking segment, gather information about the type of account (checking or savings), the bank’s name, its routing number, and the specific account number.

Step 3: Draft Authorization Statement

The heart of your form is the authorization sample statement. This should be a clear, concise paragraph detailing what the account holder is agreeing to. It gives your company permission to initiate the specified ACH transaction. Ensure it’s written in plain language, so it’s easily understood by anyone who reads it.

Step 4: Add Signature and Date

Your form must have a dedicated section for the account holder to sign and date. This formalizes their sample agreement to the terms specified in the form. A signature reaffirms their consent, and the date provides a clear timestamp for when they gave this authorization, helping avoid potential future disputes.

Step 5: Implement Disclaimers

To safeguard both parties, include vital disclaimers. Highlight how one can terminate the agreement format and the steps to take if there are discrepancies or errors in transactions. Offering clarity on these aspects can provide assurance to the account holder and reduce potential liabilities for your company.

Can I revoke an ACH authorization?

Yes, consumers can revoke their authorization by notifying their bank or the business with which they set up the ACH transaction. It’s always recommended to do this in writing and ahead of the next scheduled transaction.

How long are ACH transactions retained on record?

Typically, financial institutions are required to retain records of ACH transactions for six years.

Are there any fees associated with ACH transactions?

While ACH transactions can be more cost-effective than other methods, some banks or businesses might charge nominal fees. It’s crucial to check the terms before setting up any transaction.

What is an ACH vendor form?

An ACH vendor form is a document that a vendor completes to allow a business or organization to make electronic payments directly to the vendor’s bank account through the Automated Clearing House (ACH) network. It typically includes the vendor’s bank account details, routing number, and authorization for direct deposits or withdrawals.

In Conclusion, As the world continues to move towards a more digitized future, understanding mechanisms like ACH forms becomes increasingly essential. These forms not only provide a streamlined approach to electronic transactions but also offer layers of security and trust between the transacting parties. You can also see more templates in SampleTemplates.com site!

Related Posts

Sample Sworn Affidavit Forms

Vehicle Inspection Forms Samples & Templates

Sample Employee Advance Forms

Sample Child Travel Consent Forms

Sample Testimonial Request Forms

Sample Employee Details Forms

Sample Divorce Forms

Sample Attestation Forms

Employee Performance Appraisal Form Templates

FREE 9+ Sample Presentation Evaluation Forms in MS Word

FREE 10+ School Admission Form Samples & Templates in MS Word | PDF

FREE 30+ Patient Consent Form Samples in PDF | MS Word

FREE 10+ Sample Sign Off Form Templates in PDF | MS Word

FREE 11+ Sample Medical Consultation Forms in PDF | MS Word

FREE 8+ Sample Donation Forms in PDF | MS Word