In today’s fast-paced and dynamic world, the concept of payment plans has gained significant importance. Payment plans are financial planner arrangements that allow individuals or businesses to spread the cost of a purchase over a specified period. Payment plans provide financial flexibility for both consumers and businesses. Consumers can choose the payment terms that suit their needs, such as the duration of the budget plan and the size of the installment payment plans. This flexibility allows individuals to align their payments with their cash flow and financial obligations.

20+ Payment Plan Form Samples

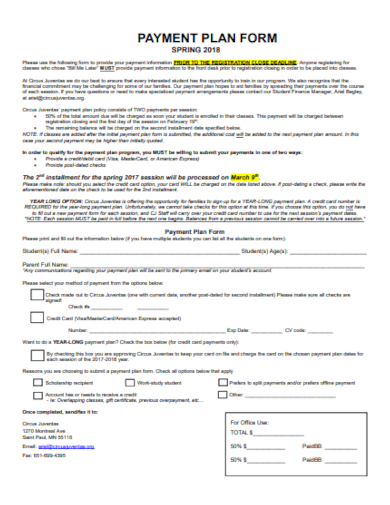

1. Payment Plan Form Template

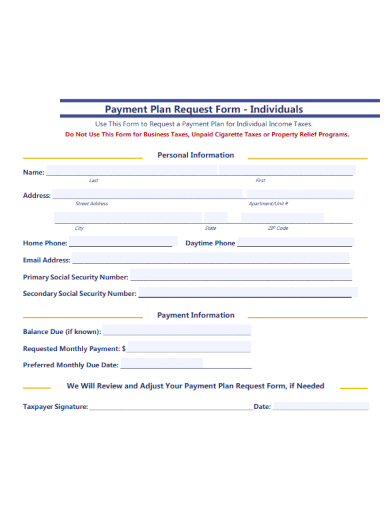

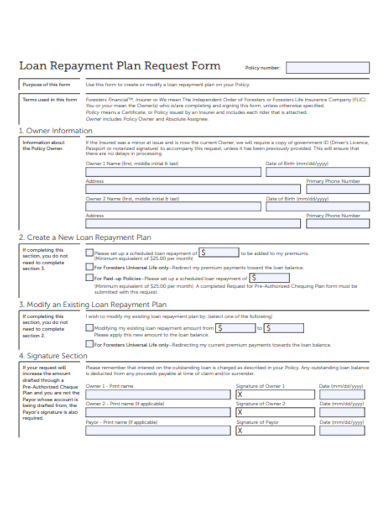

2. Payment Plan Request Form

3. Printable Payment Plan Form

4. Medical Payment Plan Form

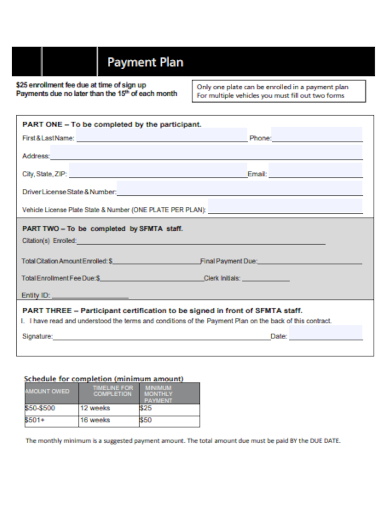

5. Vehicle Payment Plan Form

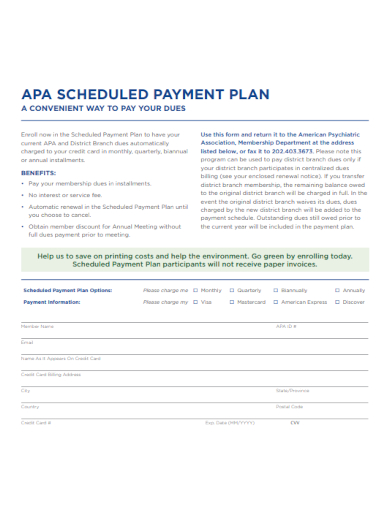

6. Scheduled Payment Plan Form

7. Simple Payment Plan Form

8. Payment Plan Agreement Form

9. Employee Payment Plan Form

10. Blank Payment Plan Form

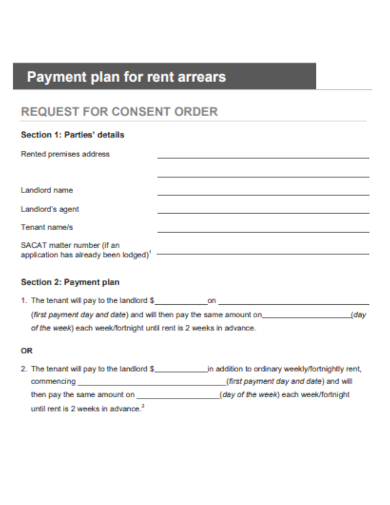

11. Rent Payment Plan Form

12. Personal Payment Plan Form

13. Fee Payment Plan Form

14. Dental Payment Plan Form

15. Credit Card Payment Plan Form

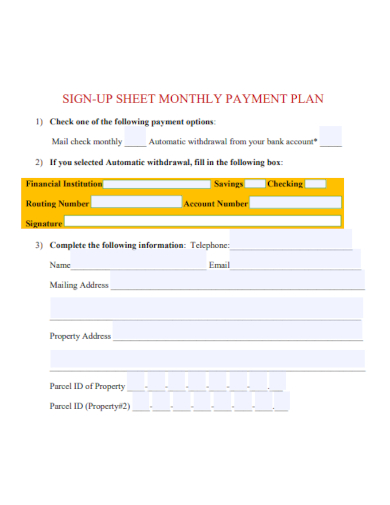

16. Monthly Payment Plan Form

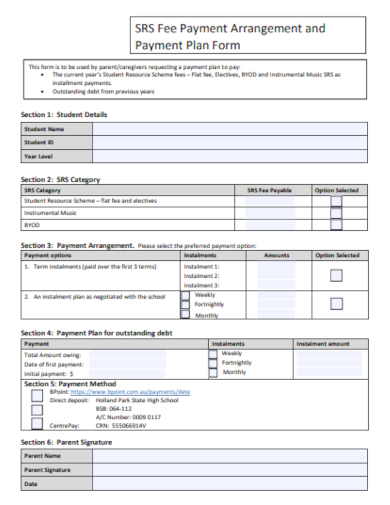

17. Payment Arrangement Plan Form

18. Loan Payment Plan Form

19. Payment Plan Form Document

20. Patient Payment Plan Form

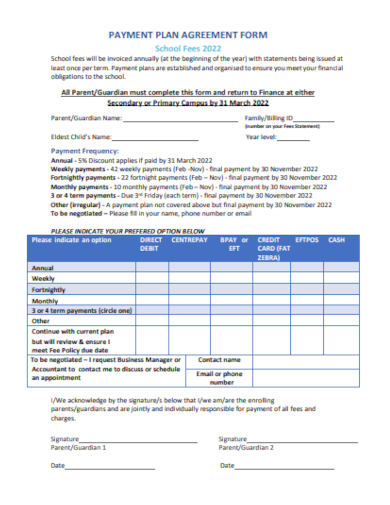

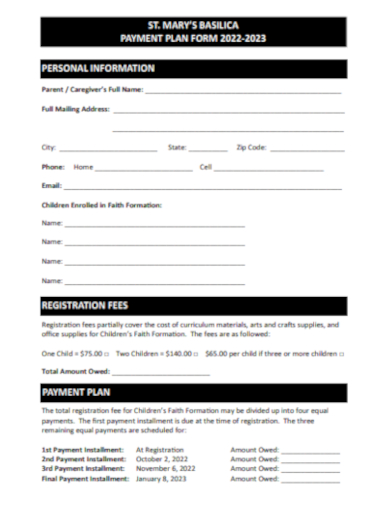

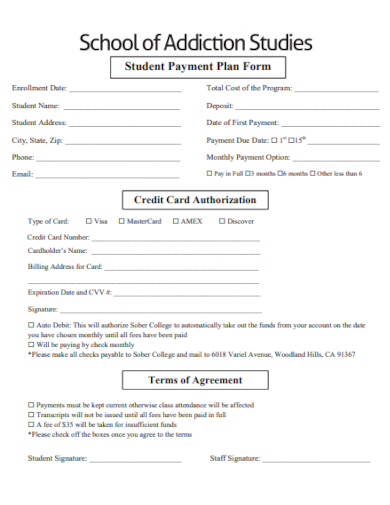

21. School Payment Plan Form

What is Payment Plan?

A payment plan refers to a financial arrangement between a creditor (such as a business or institution) and a debtor (an individual or entity) that outlines the terms and conditions for the repayment of a debt or the purchase of goods or services contract. It involves dividing the total cost or outstanding balance into a series of regular payments over a specified period.

How To Make Payment Plan?

Payment plans typically include details such as the amount and frequency of payments, the duration of the plan, any applicable statement of interest rates or fees, and any consequences for missed or late payments. Creating a payment plan involves several steps to ensure that both parties involved, the creditor and the debtor, are in agreement on the terms and conditions of the arrangement. Here is a general guideline on how to make a payment plan:

Step 1- Assess the Financial Situation

Start by assessing the debtor’s financial situation and determining their ability to make regular payments. Consider factors such as income report, expenses tracking, and any existing financial obligations. This assessment will help determine the feasibility of a payment plan and the affordability of the proposed terms.

Step 2- Define the Terms

Once you have a clear understanding of the debtor’s financial situation, define the terms of the payment plan. This includes determining the total amount owed or the purchase price of the goods or services, the duration of the plan, and the frequency and amount of each payment. Consider any applicable interest rates or fees that may apply.

Step 3- Communicate with the Creditor

If you are the debtor, contact the creditor or the party you owe the debt to. Explain your financial situation and propose the payment plan you have formulated. Open communication is crucial to reaching a mutually acceptable agreement.

Step 4- Negotiate and Reach an Agreement

Discuss the proposed payment plan with the creditor and be open to any adjustments or suggestions they may have. Negotiate the terms until both parties reach a consensus and agree on a payment plan that is fair and realistic for both sides.

Why would I need a payment plan?

Payment plans are useful when you cannot afford to make a lump sum payment upfront for a large purchase or when you need to repay a debt gradually to manage your finances effectively.

What factors should I consider when creating a payment plan?

When creating a payment plan, consider your income, expenses, and other financial obligations. Ensure that the proposed payment amounts are affordable and realistic based on your financial capabilities.

Can I modify a payment plan if my financial situation changes?

If your financial situation changes, it is advisable to communicate with the creditor promptly. They may be willing to modify the payment plan to accommodate your new circumstances.

Payment plans have become an integral part of modern financial systems, benefiting both consumers and businesses. They provide accessibility and affordability, offer financial flexibility, drive sales, enhance cash flow, and minimize debt accumulation. As payment plans continue to evolve and adapt to changing market dynamics, they play a crucial role in fostering economic growth, improving consumer welfare, and facilitating the expansion of businesses. Responsible use of payment plans can empower individuals to meet their financial needs while maintaining a healthy financial profile.

Related Posts

Sample Employee Declaration Forms

Sample Release of Liability Forms

Sample Training Feedback Forms

Sample Sworn Affidavit Forms

Vehicle Inspection Forms Samples & Templates

Sample Employee Advance Forms

Sample Child Travel Consent Forms

Sample Testimonial Request Forms

Sample Employee Details Forms

Sample Divorce Forms

Sample Attestation Forms

Employee Performance Appraisal Form Templates

FREE 9+ Sample Presentation Evaluation Forms in MS Word

FREE 10+ School Admission Form Samples & Templates in MS Word | PDF

FREE 30+ Patient Consent Form Samples in PDF | MS Word