Schedule C form is a critical form for the proprietors and the service providers or trustees. It helps to file the income tax, calculate and keep an official record of the sales and expense and all such monetary matters. It is the Sample Form to turn your income into white money, and it is necessary to avoid legal cases and raids from income tax officers and other such higher authorities.

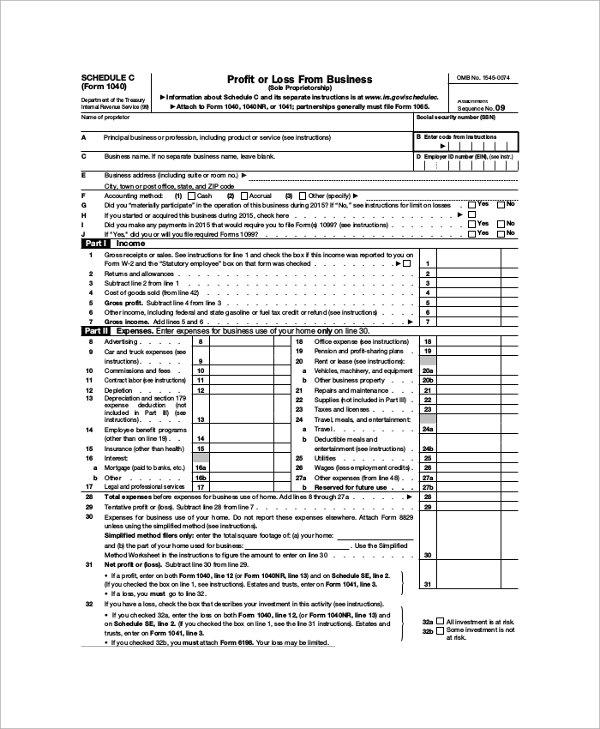

Sample Schedule C Form 1040

Schedule C form 1040 is to account and record the profit and loss from a business where one is the sole proprietor. Apart from personal details, it has a section to record the incomes, expenses, costs of goods sold, other costs like vehicle expenses, electricity used and so on.

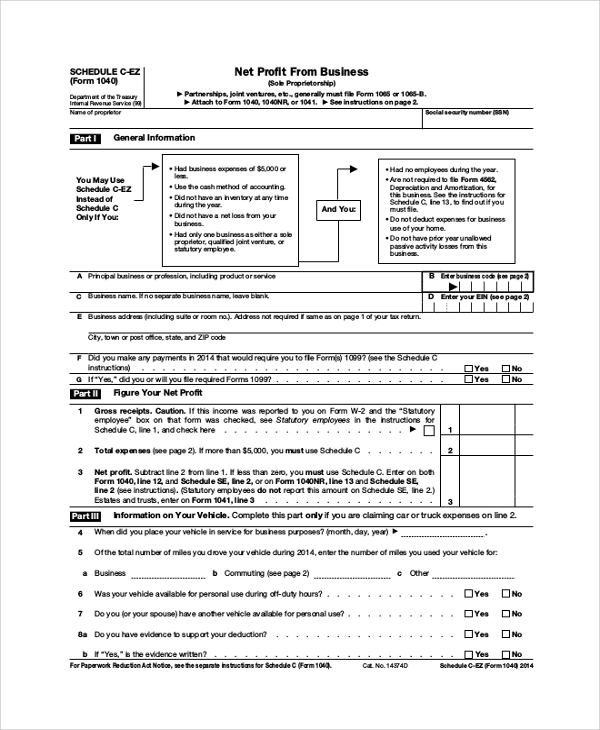

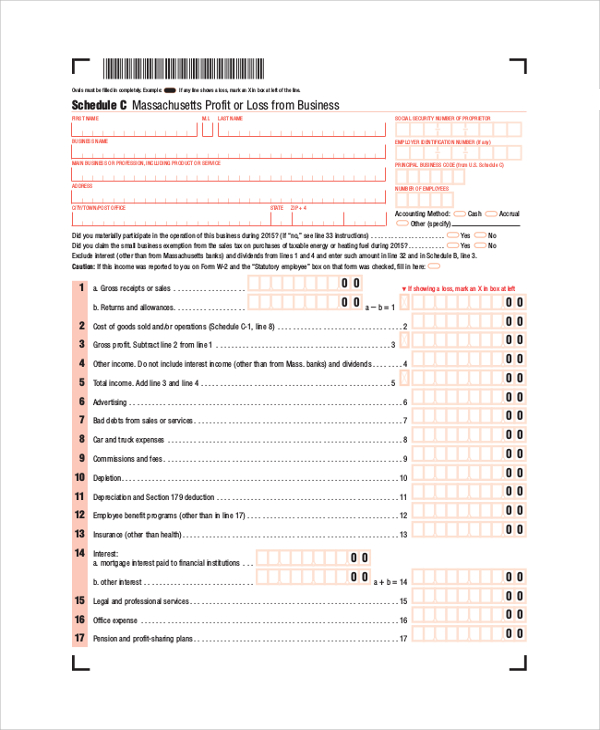

Sample Schedule C Tax Form

This Schedule C Tax Form is to file net profit from proprietorship business. The first section is for general information of the business and the proprietor. The second part deals with figuring out the net profit with gross receipt, total expenses, and other expenditures.

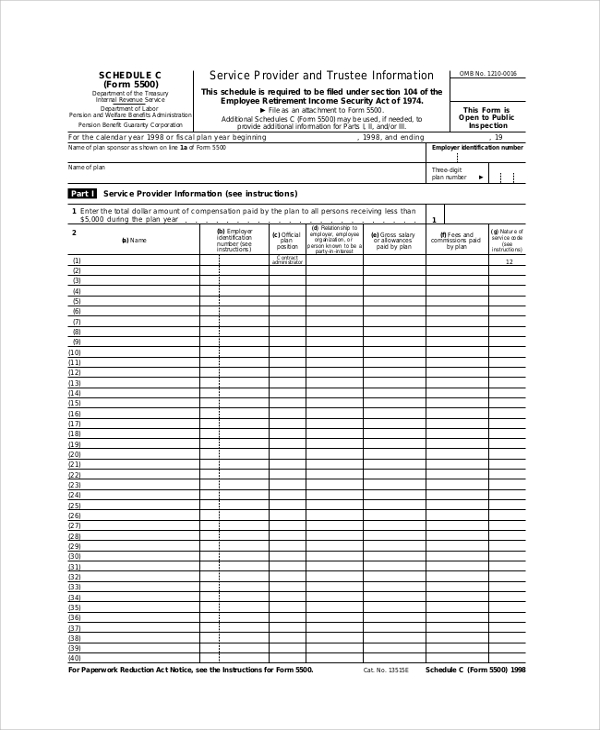

Schedule C Sample Form 5500

Schedule C form 5500 is for service providers and trustees. The first section records the details of the service providers with name, employee id, position, relationship, fees and nature of service. Then it has a collection of trustee information and termination information if any.

Usage of Sample Schedule C Forms

Schedule C forms are for the professionals to file their incomes taxes, for the proprietors to show their income, expenditure and calculate net profit of various parameters on the form to make it legal and official. Similarly, for service providers and small business owners, this type of forms helps to make all the transactions clean to avoid raids and other monetary fines due to necessary hiding details. You may also see the Sample Schedule A Forms.

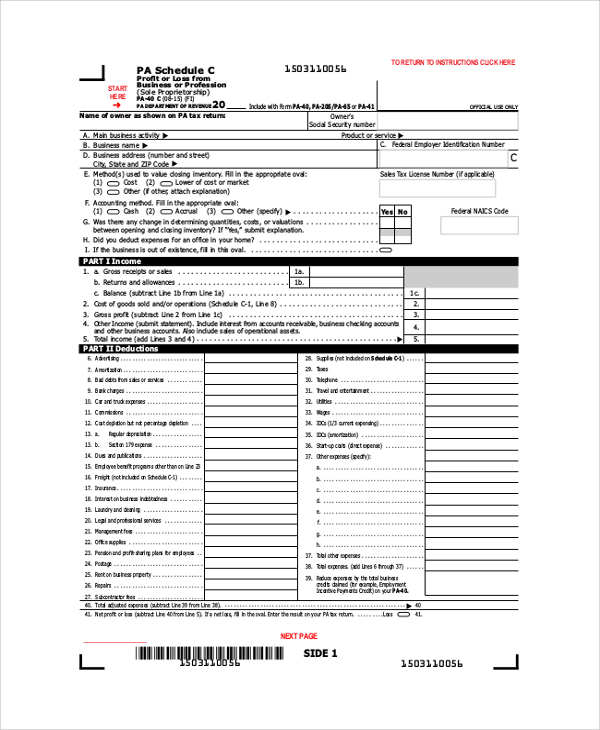

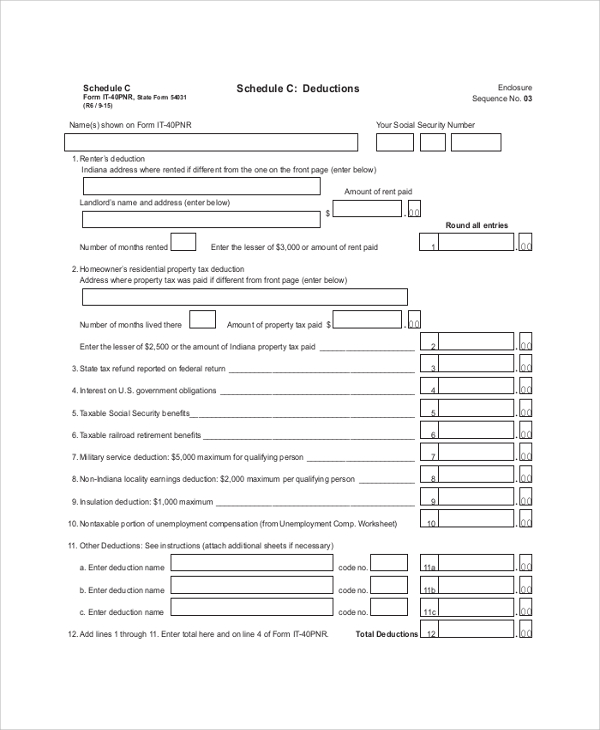

Federal Tax Form Schedule C Sample

Federal Tax Form Schedule C is for recording loss or profit from business or profession. It has provisions such as personal details and business or profession details. Then it moves on to record the net income and the deductions on various parameters. It records the cost of goods or services sold, depreciation, and an overall overview.

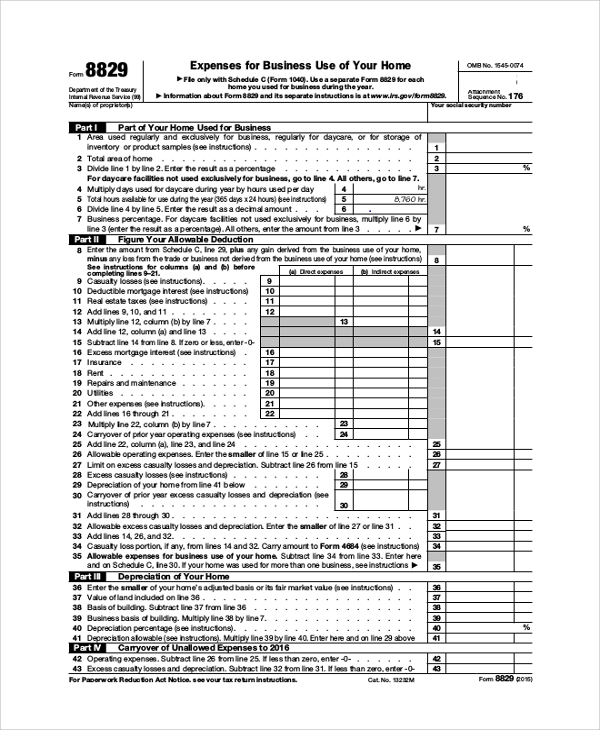

Sample Schedule C Form 8829

Schedule C form 8829 deals with the expenses for business use of your home. It deals with the part of the home used for business, helps to figure out other allowed deductions with 35 parameters and depreciation of the home and carryover of non-allowed expenses.

Schedule C Form Profit or Loss from Business

Targeted Audience for the Schedule C Form Samples

The targeted audiences for the Schedule C forms are the proprietors who are running a business or service providing company. These forms help to keep track of all the monetary transactions and file taxes accordingly. It is mandatory for the professionals, service providers, trustees and even home lenders and landlords renting their house for commercial purposes. You may also see the Staff Schedule Samples.

Schedule C Form Deductions Format

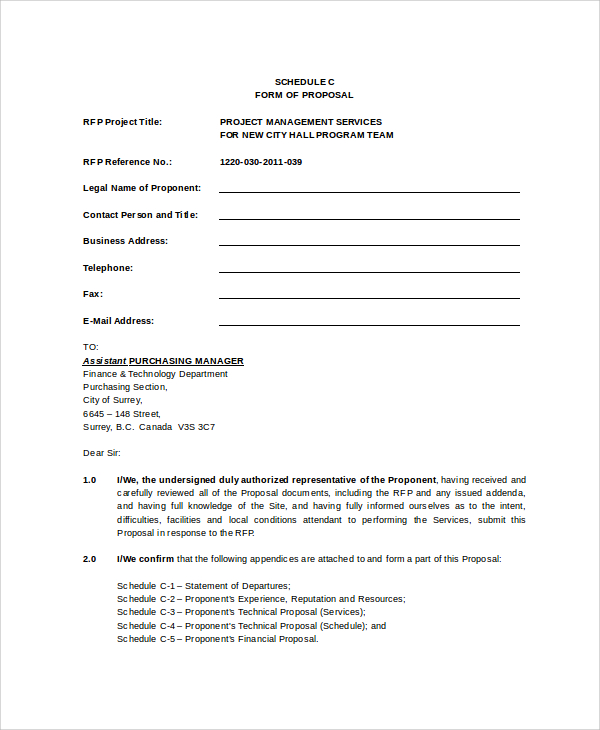

Schedule C Form of Proposal Example

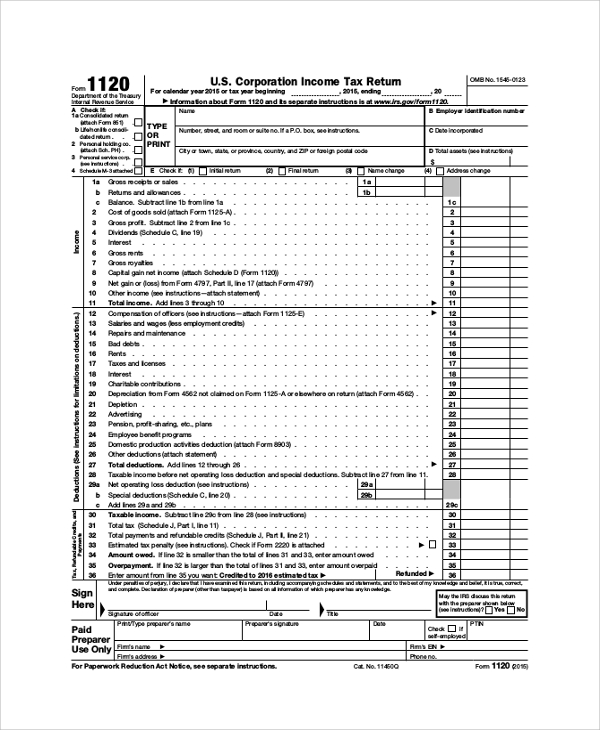

Schedule C Form Corporation Income Tax Return

Various types of Schedule C forms are applicable to the proprietors, professionals, home lenders, service providers and trustees. Some forms are to calculate the income and file taxes while others are to keep a record of expenses, sales, and other issues that need to be made official and show to the government or to the respective officials. It helps to run the business smoothly and avoid all sorts of legal issues. You may also see the Sample Affidavit of Support Forms.

If you have any DMCA issues on this post, please contact us.

Related Posts

Agreement Form Samples & Templates

Vehicle Inspection Forms Samples & Templates

Sample Employee Advance Forms

Sample Child Travel Consent Forms

Sample Testimonial Request Forms

Sample Employee Details Forms

Sample Divorce Forms

Sample Attestation Forms

Employee Performance Appraisal Form Templates

FREE 9+ Sample Presentation Evaluation Forms in MS Word

FREE 10+ School Admission Form Samples & Templates in MS Word | PDF

FREE 30+ Patient Consent Form Samples in PDF | MS Word

FREE 10+ Sample Sign Off Form Templates in PDF | MS Word

FREE 11+ Sample Medical Consultation Forms in PDF | MS Word

FREE 8+ Sample Donation Forms in PDF | MS Word