Taking control and maintaining transparency are two of the most important aspects of running and keeping financial management plans and development plans in order. Covering and keeping documentation of each expenditure and transaction enhances the ability of the business owner to make better judgments and decisions. Maintaining accuracy on financial reports and records such as the business’ sales performance evaluation, expense reports, and purchase orders are not only important, but they are also legal requirements.

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

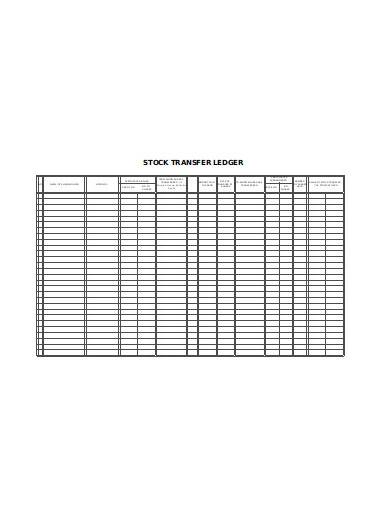

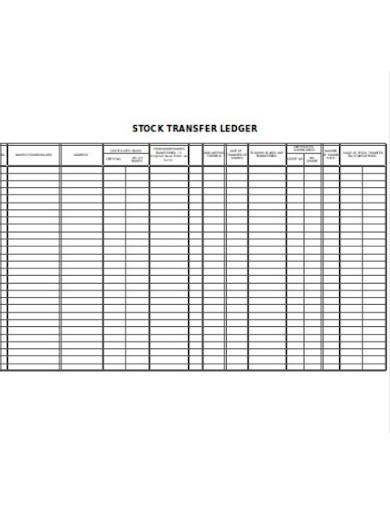

1. Stock Transfer Ledger Template

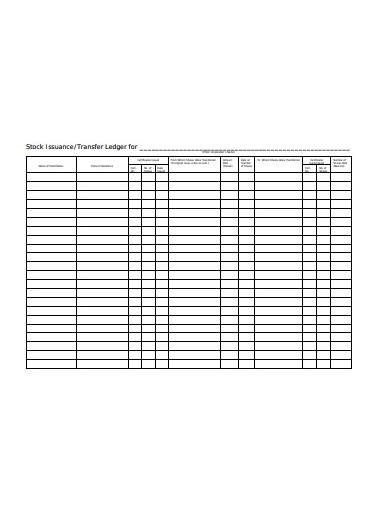

2. Stock Insurance Transfer Ledger Template

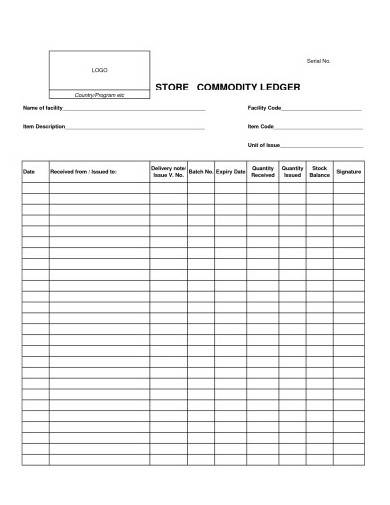

3. Store Commodity Ledger Template

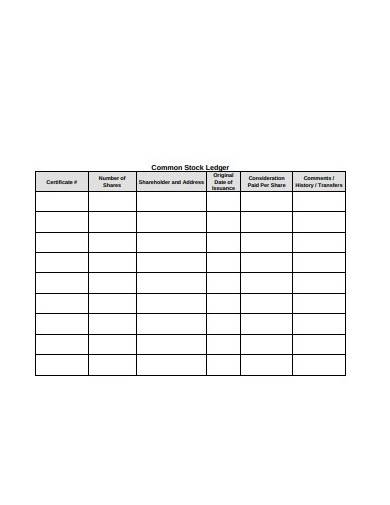

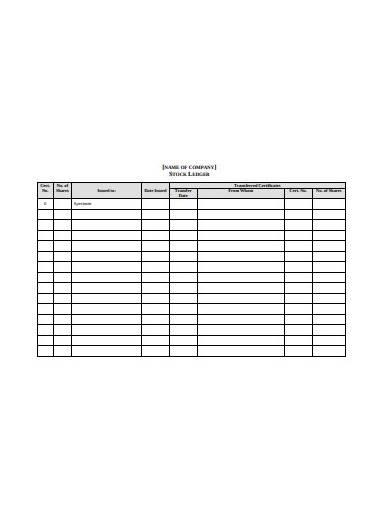

4. Common Stock Ledger Template

5. Basic Stock Ledger Template

6. Stock Transfer Ledger Example

What is a Stock Ledger?

A stock ledger is a log book or document with tables that are utilized and kept by businesses or corporations to list the names of stockholders, the number of their holdings, the contributions they have made for the said stock, and documentation of the transfer of ownership. A business owner’s corporate secretary or corporate attorney keeps this document updated by modifying it based on all stock sales and purchases. Companies that do not comply with keeping a stock ledger result in a violation of the corporate bylaw.

How to Keep a Stock Ledger

Stock ledgers are legal documents that help corporations in handling their roles and responsibilities during stock audits while maintaining their financial accountabilities. Stock ledger templates commonly contain columns to enter all details relevant to the shareholders and their stock movement information. Depending on the law in the state where the corporation is located, stock ledgers can be in a form of a physical ledger or a digital document that is maintained using specialized software. Stock ledgers are part of a corporate’s records kit and must be kept in their corporate records book.

Step 1: Keep Your Receipt Voucher

When an item is purchased, all of its details will be provided in a receipt voucher which includes information on the location where the items were purchased, who sold them, the date of the transaction, the number of items purchased, the price of each item, and the total price.

Step 2: Create a New Ledger

Once you have kept a record of the items you have received on your voucher, you can now create a new stock ledger. Creating a new ledger starts with numbering all of its pages and providing certification, stating that the ledger contains a specific number of pages. Each of your items must be listed on different pages.

Step 3: List the Items on the Receipt Vouchers in the Stock Ledger

There are two general types of stock ledgers which are the dead stock ledger and expendable stock ledger. To list items in a dead stock ledger, enter the received item under the serviceable item column, and its quantity, and must be signed by the storekeeper. If you are using an expendable stock ledger, enter the time under receipt items, their number, and the signature of the storekeeper.

Step 4: Issue the Items

Items are issued for the dead stock ledger when it is approved by the committee authorized by the department head while there is no need for such a committee for the issuance of items on the expandable stock ledger. However, both issuance processes must provide an issuance voucher.

FAQs

What information must a stock ledger contain?

A stock ledger must record essential information such as stock certificate number, number of shares, the shareholder who was issued the shares, address of the shareholder who was issued the shares, date of issuance, the amount paid for the shares, and a notation that covers the history of the stock transfer.

What is the purpose of keeping a stock ledger?

With a stock ledger, corporations can easily identify all their shareholders at any given time. It also provides a summary of recorded stock transactions and serves as a working document for all current and past shareholders, containing all of their personal details as well as details on the shares they own.

What are the advantages of using a stock ledger?

Stock ledgers allow corporations to keep accurate records of their stock transactions while increasing their efficiency in tracking their stock movements and ensuring their compliance with relevant legislations and laws, improving accuracy in stock valuation, reducing the risk of fraud and abuse, and improving their transparency.

A stock ledger is one of the most essential documents for all corporations or public limited companies that keeps records and tracks all of their stock transactions. This document is used to keep all of their business shares as well as the details on when shares were initially issued and other stock transfers. Stock ledgers are also known as stock transfer ledger templates, corporate stock ledgers, and stock books.

Related Posts

FREE 10+ School Consent Form Samples & Templates in MS Word | PDF

FREE 10+ School Clearance Form Samples & Templates in MS Word | PDF

FREE 10+ School Admission Form Samples & Templates in MS Word | PDF

FREE 6+ Metro Pass Request Form Samples & Templates in PDF

FREE 10+ Mentor Application Form Samples in MS Word | PDF

FREE 10+ Hazard Assessment Form Samples in PDF

FREE 9+ Medical Release and Liability Form Samples and Templates in MS Word | PDF

FREE 10+ Faculty Self Assessment Samples in PDF

FREE 13+ Customs Declaration Form Samples in PDF | MS Word

FREE 10+ Customer Analysis Samples in PDF | MS Word

13+ FREE Contractor Evaluation Form Samples in MS Word | PDF

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 10+ Annual Evaluation Form Samples [ Employee, Manager, Performance ]

FREE 5+ Nonprofit Program Budget Samples [ Youth, Operating, Startup ]

FREE 11+ Budget Reconciliation Templates in PDF | MS Word