Owning a car can be a little demanding. If your car is not insured, you have to make sure that it has liability insurance that covers any damage your property might encounter. You can get car insurance by selecting a type that is suitable for your needs. But how would you know what type of insurance your car needs? Understandably, choosing insurance can be difficult. Because you need to consider many things and study them to understand its benefits fully, so, before selecting insurance, make sure you are knowledgeable about it. A liability policy is not only for your automobile. Hence, it is more than just vehicle insurance.

What Is a Liability Policy?

Know that insurance policy covers not only your automobile but also anyone subjected to a legal proceeding because of damages or injuries, such as business persons, event organizers, medical or law practitioners. A liability policy, also known as liability insurance, is a release agreement that protects the insured party from complaints about damages or injuries filed against them. Unlike liability waiver, it will ensure legal costs and any compensation to the insurer if it found the insured party as legally liable.

Given that anyone faces a different level of risk, the reason why everyone needs liability insurance. The extent of coverage you need will depend on various situations. So, here are types of business insurance to deepen your understanding.

Commercial General Liability (CGL) Policy. This insurance policy ensures protection to business against complaints about physical injuries and damage of property arising in the business’s premises, operations, products, or completed operations. It also provides payouts to the loss caused by advertising and personal injuries.

Directors and Officers Liability Insurance. If there are claims made by employees, suppliers, competitors, regulators, customers, shareholders, or stakeholders, this policy will ensure coverage against it.

Professional Indemnity Insurance. A liability policy that covers a business or an individual’s mistake of advice or professional service to clients is this type for. It provides compensation if clients sued the company or the individual who offered the services.

Cyber Risk Insurance. Businesses and individuals who lose any property because they engaged in any electronic activity can be covered by cyber risk insurance. Additionally, it assists in the recovery of the insured party after a violation in cybersecurity.

Commercial Crime Insurance. This liability insurance type protects businesses against dishonest employees, theft of money, burglary, robbery, forgery, and computer fraud. Which means a company will receive coverage against employee fidelity and fraud.

Carrier Legal Liability Insurance. This type insured the physical loss or damage to commodities because of fire or vehicular accident while they are on the road. However, the latter will be protected if it is in the custody of an insured party.

Product Liability Insurance. This liability policy insured the business of any claim from damages or loss caused by products or services. The complaints could be from personal injury or property damage.

Trade Credit Insurance. The loss to credits has a lot of risks. One way around this is applying for trade credit insurance, which means that this insurance policy will protect the business from loss of monetary resources caused by bankruptcy, insolvency, and unpaid dues.

The availability of insurance coverage is vast. That said, any individual, or mostly business, has to choose liability insurance that will protect them in case of damage or loss. It is important not to lose your money in any adverse circumstance.

Liability Policy Graph

Some of the most popular liability insurance types taken out by businesses are motor insurance policy, medical professional liability insurance, product liability insurance, and directors and officers liability insurance. The products of this insurance are essential for the financial status of companies. That resulted in the growth of the liability insurance industry in the United States. According to Census.gov, in 2017, the percentage of Americans with health insurance coverage was 91.2 % of the population. The result was a 2.3 % increase from 2016.

FREE 11+ Liability Policy Samples & Templates in PDF | MS Word

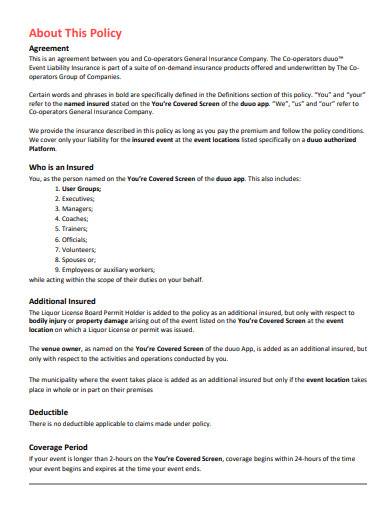

1. Event Liability Policy Template

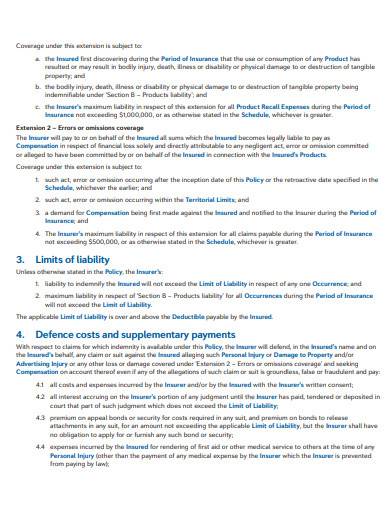

2. Products Liability Insurance Policy Template

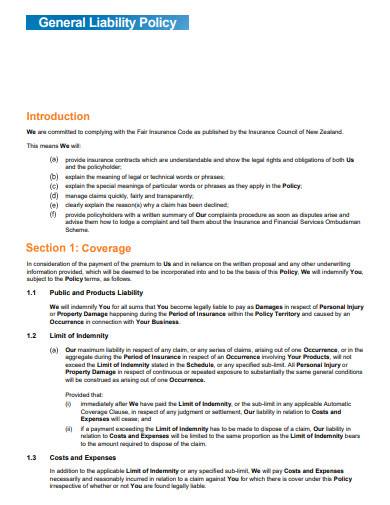

3. General Liability Policy Template

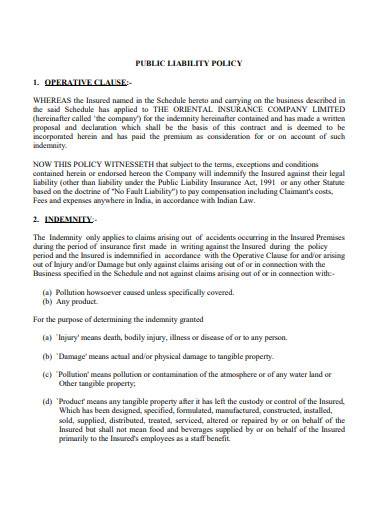

4. Sample Public Liability Policy Template

5. Professional Liability Insurance Policy

6. Public and Products Liability Insurance Policy

7. Sample Product Liability Insurance Policy

8. Motor Vehicle Liability Policy Template

9. Public Liability Policy Template

10. Lawyers Professional Liability Insurance Policy

11. Basic General Liability Policy Template

12. Sample Liability Insurance Policy Template

How to Choose the Best Liability Policy

Shopping for insurance liability, whether for your personal or business coverage, can be complicated. It might take so much of your time, too. However, you can not sign up for insurance without understanding what you are buying. Consider that being under-insured could lead to a potential financial disaster. If you invested in insurance that is not helpful to you, you could be wasting your money. Here are the things you should know to spend on the right liability policy.

Know Your Needs

Asking yourself, “How much insurance do I need?” could be a question that is hard to answer. Buying inadequate insurance could risk your finances, but over-insurance could be a burden to you. The basis of purchasing insurance will depend on various situations. However, if there is nothing that limits you from acquiring liability insurance or release of liability, then buy insurance that is enough to cover future loss and damage.

Understand the Insurance and Its Benefits

Insurance companies make charges based on several factors. Understanding these will help you keep an eye on the benefits and costs of the insurance. Usually, you would not be getting the same compensation for similar damage or loss. For example, if a business caused injury to a customer because of their products or services, the customer would not be getting the same amount of compensation as to what a similar incident covered. Factors such as business location and claim history can affect the coverage.

Seek Professional Advice

Before signing up for your insurance plan, make sure to talk to an expert. If you seek advice from a person who mastered liability insurance, you will easily select the best policy for you. This professional can talk you through anything comprehensive, such as costs, amount of coverage you need, and umbrella policy.

Learn How to File Complaints

In case of accidents, make sure you know where to go or who to call. As the insurance purchaser, you need to do your part in monitoring the policies you have taken. Without knowing how to process the insurance will put the agreement of no use.

FAQs

What does liability insurance cover?

Liability insurance serves as a certificate that covers any cost arising from damages or injuries caused by accident. If an insured person is found at fault in an accident, the insurance company will cover the costs of damages and injuries to another person involved.

Who needs general liability insurance?

Everyone faces risks, whether in business or personal whereabouts. That is why there is a need to have liability insurance.

Is third party insurance valid?

Third-party insurance is not valid to cover damages sustained in an accident. For example, if you bumped into another car, then the loss and damages will be covered, not by a third-party insurance provider. Hence, an active insurance policy will cover the costs.

Indeed, insurance policies are complicated matters to get into. But no matter how difficult to understand these policies are, its benefits will protect you from any complaints. If you want to protect anything that you own, make sure to choose the best liability policy so that you don’t have to struggle in your finances.

Related Posts

FREE 10+ School Data Protection Policy Samples in MS Word | PDF

FREE 10+ Student Travel Policy Samples in MS Word | Google Docs | Pages | MS Outlook | PDF

FREE 10+ Construction HR Policy Samples in MS Word | Google Docs | PDF

FREE 13+ Website Privacy Policy Samples in MS Word | Apple Pages | PDF

FREE 20+ Open Door Policy Samples in PDF

FREE 20+ Observation Policy Samples in PDF | MS Word

FREE 15+ Construction Safety Policy Samples in MS Word | Google Docs | PDF

FREE 20+ Student Feedback Policy Samples in PDF

FREE 30+ Fee Policy Samples in PDF | MS Word

FREE 29+ Work Policy Samples in PDF

FREE 20+ Recruitment Policy Samples in PDF

FREE 20+ Policies and Procedures Samples in MS Word | Google Docs | PDF

FREE 50+ Feedback Policy Samples in PDF | MS Word

FREE 10+ Student Freedom of Expression Policy Samples in PDF

FREE 10+ Suicide Prevention Policy Samples in MS Word | PDF