When you purchase a rental property, you are purchasing both the real estate and the revenue generated by the property. A metric like price-per-square-foot makes determining the worth of a home very simple. However, calculating the value of an income stream using a rent roll is more complicated, especially during periods of extraordinary economic circumstances or economic uncertainty. Here’s how to read and use a rent roll to figure out how much a rental property is worth before you buy or sell it.

10+ Rent Roll Samples

A rent roll is a necessary document that helps landlords and others to readily see what rents are due and what rents have been gathered on an income property. It concentrates on gross rent rather than net rent after deductions for monthly mortgage, insurance, taxes, and utilities. Keeping accurate financial records is critical in the day-to-day operations of an investment property, as well as for prospective buyers if you’re thinking about selling. Rent rolls can assist landlords in managing their finances and increasing profits, as well as assisting you in selling your investment property when the time comes.

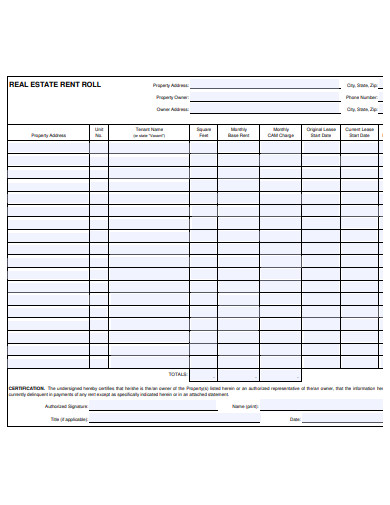

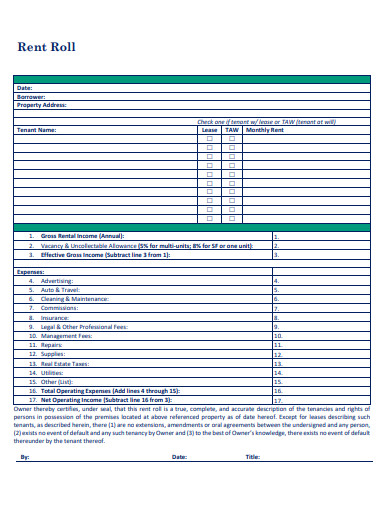

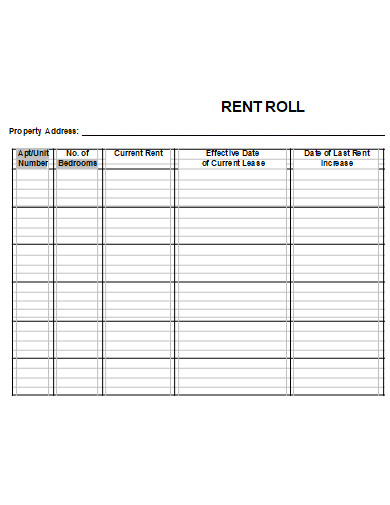

1. Rent Roll

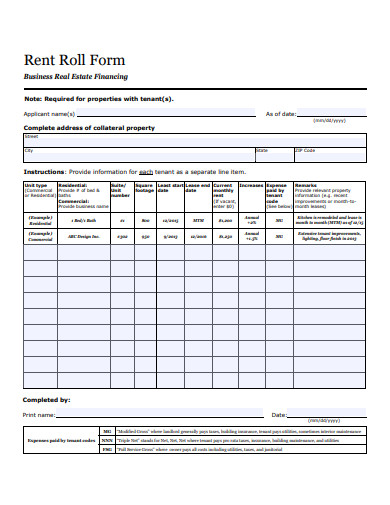

2. Rent Roll Form

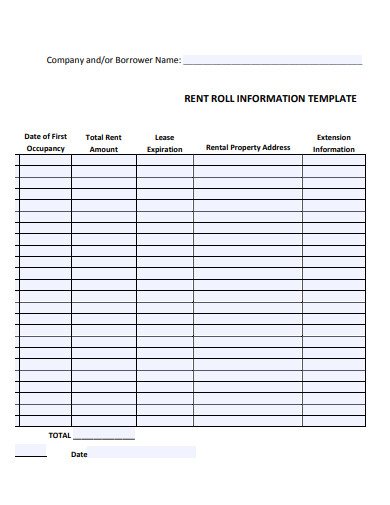

3. Rent Roll Information Template

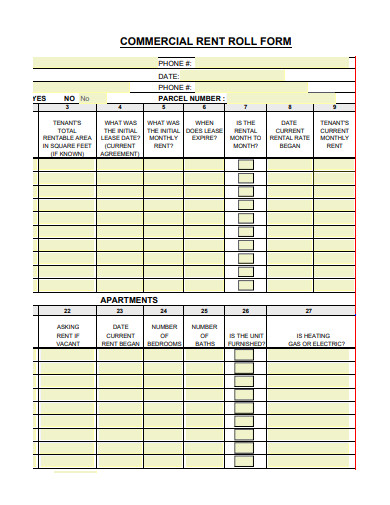

4. Commercial Rent Roll

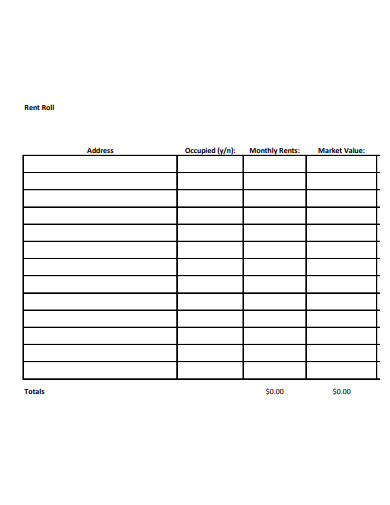

5. Simple Rent Roll

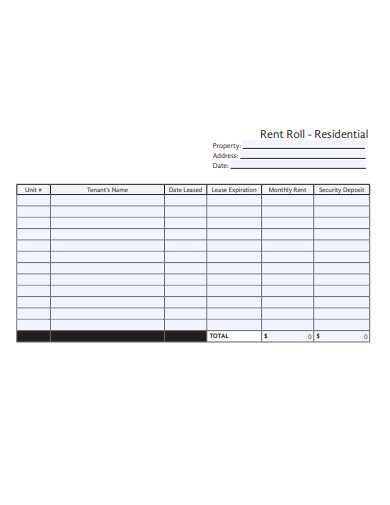

6. Residential Rent Roll

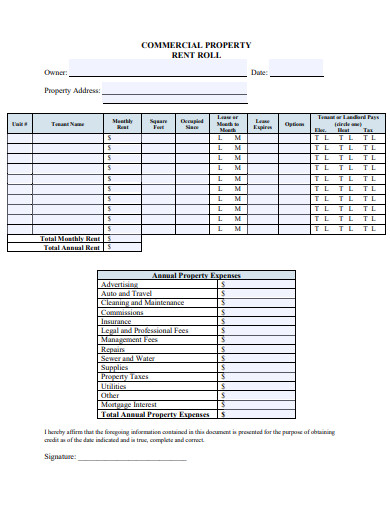

7. Commercial Property Rent Roll

8. Basic Rent Roll

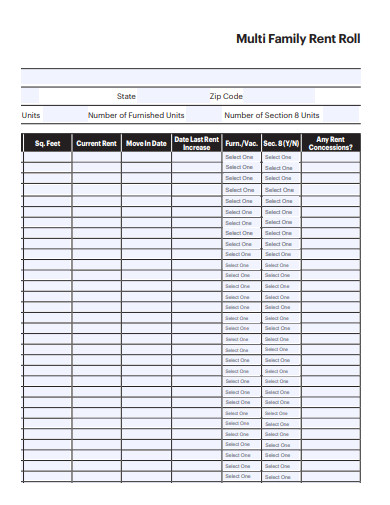

9. Multi Family Rent Roll

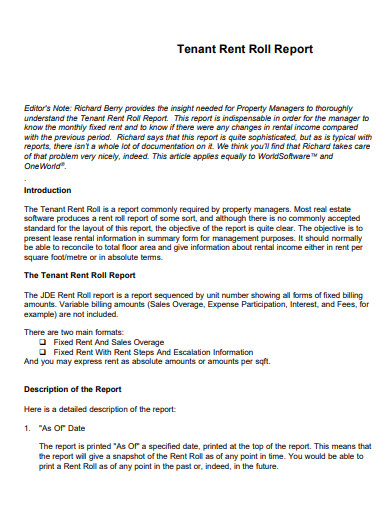

10. Tenant Rent Roll Report

11. Printable Rent Roll

Creating a Rent Roll

A software tool, such as Microsoft Excel, may simply construct a rent roll. Simply use the appropriate headings to mark the rows and columns, then enter the data as you acquire it. Because the rent roll is tailored to the landlord’s demands, the details included in it can differ, but a good rent roll contains certain relevant data.

Document heading

This will be at the start of the spreadsheet and will contain any identifiable details for the landowner and investment property. Name of property owner, location of rental property, and, if appropriate, name of property manager/management business.

Unit specifics

Each rental unit should have its own row with the following information:

- The unit number on the rental contract should match this, for example, Apartment #1 or 3A.

- What is the unit’s price per square foot? When checking rent prices to other units in the vicinity, this information is useful.

- The number of beds and baths can assist you figure out if you’re charging fair market rent for the property.

- How much did you earn as a security deposit from each tenant when they transferred in? The first month’s rent should not be included in this figure.

- How much does the tenant due each time rental payment is collected?

- Divide the date rent that was gathered, the amount paid, and the mode of payment into three categories.

- Also included is the date the agreement began as well as the date the first rent payment was received.

- If the lease has an end date, enter it here; otherwise, if the lease is month to month, leave it blank.

- Note whether the tenant will be responsible for any additional costs, such as utilities or maintenance services.

- Additional unit details: The landlord might use this part to include any remarks about the unit, such as a planned rent increase or planned upgrades.

Rent totals

This is the overall rent that might be taken for the property per month or year: Monthly payment collected: Add the monthly rates for each property together. The total monthly rent received is multiplied by 12 to get the annual rent.

FAQs

Who uses rent rolls?

An accurate rent roll can be beneficial to a variety of people and businesses. If you’re considering about refinancing the property, lenders will want to view the document since they’ll want to know the property’s historical and projected income. Certain government organizations, as well as any property managers you engage to manage your investment, may demand it.

How does a rent roll work?

The rent per apartment unit is broken out in a rent roll, as well as the overall rent for the entire investment property. It compiles rent information from each tenant’s lease agreement into a single, easy-to-read document. The landlord doesn’t have to waste time looking up each tenant’s agreement to figure out how much rent to charge or when the lease begins and ends.

The rent roll gives property managers and owners an advance warning indication that an issue with the tenant is emerging. If a tenant starts paying rent overdue for the first time, or if the renter is a frequent late payer, it could be a significant red flag that the tenant has to be removed and the property pre-marketed for lease to minimize vacancy and repair time. Rental property investors can use the rent roll document to increase net rental income and improve property profitability.

Related Posts

Student Research Proposal

Diet Plan

Housekeeping Resume

Marriage Proposal Letter

Nursing Resume

Fund Transfer Letter

Purchase Order Cancellation Letter

Certificate of Service

Employee Leave Form

Visitors Log

Requisition Form

Student Feedback Form

Payment Receipt Format

Formal Interview Letter

Reflective Writing