Not all businesses hold assets for sale. They create an asset management plan to effectively and efficiently handle their properties. Some of them, such as properties, buildings, vehicles, pieces of equipment, machinery, and other fixed assets, are bought for daily operating activities over a certain period of time. A depreciation schedule is a chart or table in which businesses or organizations can efficiently track their depreciation expenses with expenses sheets on each asset over the years. Depreciation is a term used to describe how much value an asset has been used up or a method that distributes the cost of a particular fixed asset over its anticipated useful life.

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

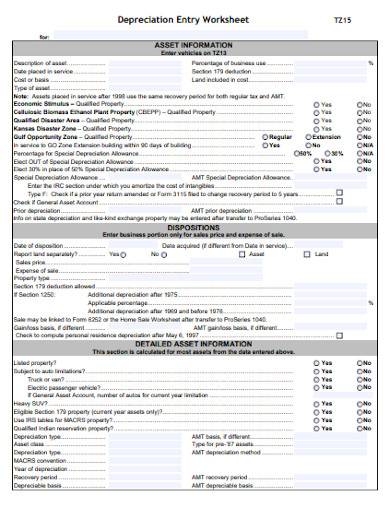

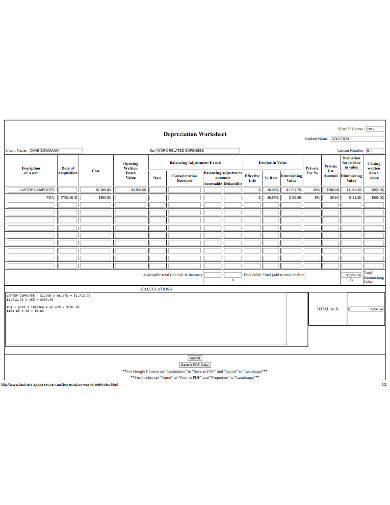

1. Depreciation Entry Worksheet Template

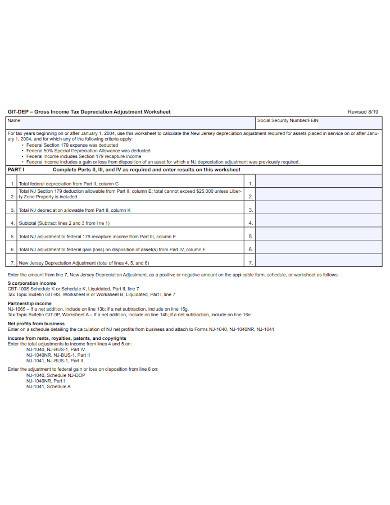

2. Income Tax Depreciation Adjustment Worksheet

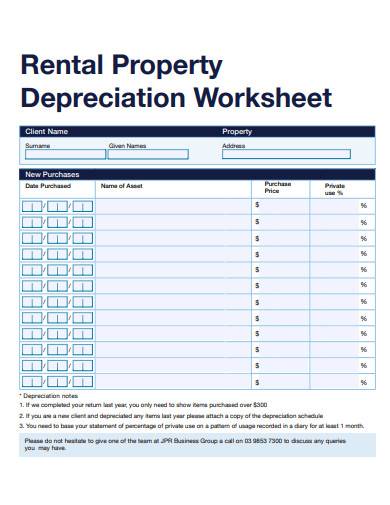

3. Rental Property Depreciation Worksheet Template

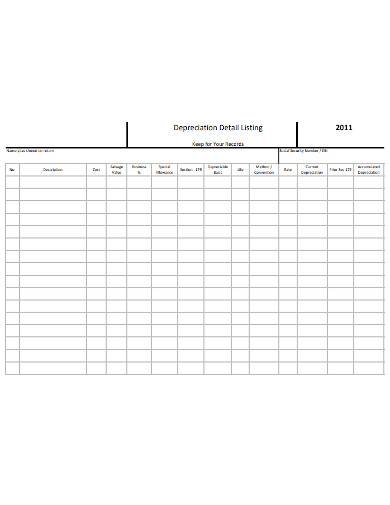

4. Depreciation Detail Listing Worksheet Template

5. Tax Depreciation Worksheet Template

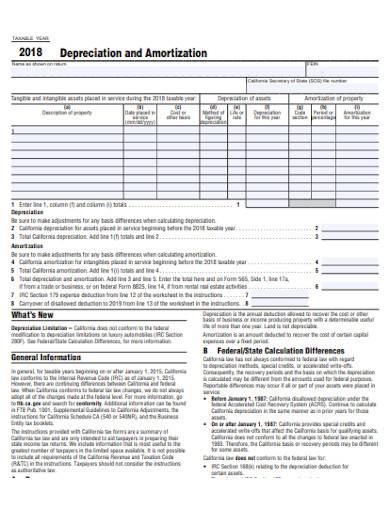

6. Depreciation and Amortization Worksheet

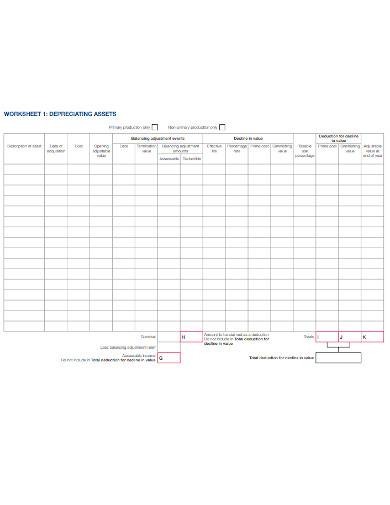

7. Depreciating Assets Worksheet Template

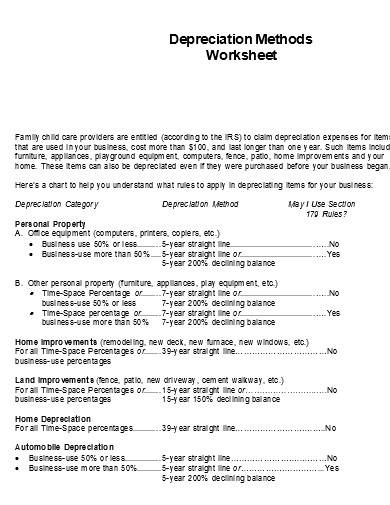

8. Depreciation Methods Worksheet Template

What is a Depreciation Worksheet?

A depreciation worksheet is an asset worksheet template that enables businesses to keep all their depreciation records stored in one centralized place, including their taxable gain, loss, or breakeven. Owning a business asset means that you have to keep track of its original basis or the cost of acquiring every asset and the depreciation you have claimed as years pass. With a depreciation schedule, you can track your long-term assets and determine how they will depreciate over time.

How to Use a Depreciation Worksheet

Depreciation is a tool used as a part of accounting management plan to distribute the valuable asset’s costs over a certain number of an accounting period. The business utilizes a depreciation schedule instead of gathering the entire expense in one period. There are different methods that business owners can use to create and maintain their depreciation schedule management plan and each of these methods calculates a part of their expense which is recognized in their business financial statements.

Step 1: Determine the Purchase Price of the Asset

The first step is determining the salvage value of your asset which is its expected sale value at the end of its useful life. You also have to determine the asset’s purchase price and its expected life in years.

Step 2: Calculate the Asset’s Value

To calculate the value of your asset, take the cost of the asset and subtract it from the salvage value. Divide the resulting value by the total number of years it is expected to be useful. This will be used for assets that are expected to degrade at a stable rate over a period of time.

Step 3: Calculate the Current Depreciation

Using the Units-for-Production method, you can calculate your asset’s current depreciation by dividing the expected units to be produced each year by the total expected units over its lifetime. Then multiply its result by the difference between the price and salvage value of the asset.

Step 4: Use Double-Declining Method

Another method to use in determining your current depreciation is the double-declining method. Here, you divide two by the asset’s expected life span in years, then multiply the result by the estimated book value for every period.

FAQs

What are the different methods of depreciation?

The different methods of depreciation include the straight-line method, the double-declining balance method, the sum-of-the-years’-digits, and the units of production method.

What is a depreciation schedule?

A depreciation schedule is a financial tool that enables companies to forecasted their fixed assets using balance sheet templates, depreciation expense or income statements, and capital expenditures or cash flow statements.

What is the financial impact of depreciation?

Depreciation is considered by companies to be an expense with no related cash outflow. It is because companies have net cash outflows in the whole amount of the asset when it was first purchased. Therefore, no further cash-related activity will take place.

Company assets such as pieces of equipment and machinery are costly. Rather than computing the entire cost of an asset in a single year, business owners utilize depreciation to distribute the cost of their assets and match their depreciation expenses to other relevant revenues in the same period of time. This enables businesses to dismiss the value of an asset over a given time period.

Related Posts

FREE 30+ Real Estate Worksheet Samples in PDF

FREE 20+ Coaching Worksheet Samples in PDF

FREE 15+ Audience Worksheet Samples in PDF

FREE 23+ Client Worksheet Samples in PDF | MS Word

FREE 24+ Enrollment Worksheet Samples in PDF

FREE 23+ Volunteer Worksheet Samples in PDF

FREE 24+ Progress Worksheet Samples in PDF | MS Word

FREE 30+ Development Worksheet Samples in PDF | MS Word

FREE 33+ Course Worksheet Samples in PDF | MS Word

FREE 16+ Verification Worksheet Samples in PDF | MS Word

FREE 14+ Feedback Worksheet Samples in PDF | MS Word

FREE 20+ Goal Setting Worksheet Samples in MS Word | Google Docs | Pages | Excel | Google Sheets | Numbers | PPT | PDF

FREE 30+ Cost Worksheet Samples in Google Docs | Google Sheets | MS Excel | MS Word | Apple Numbers | Apple Pages | PDF

FREE 50+ Assessment Worksheet Samples in PDF | MS Word

FREE 25+ Campaign Worksheet Samples in PDF