An annuity is a financial product that provides a stream of regular payment record to an individual or a group of individuals for a specific period. Annuities are usually sold through insurance agency marketing plan and are designed to provide a steady source of income statement monthly during retirement program. The application process for annuities can be complex, and it is important to understand the different types of annuities available before applying.

FREE 10+ Annuity Application Samples & Templates in PDF | MS Word

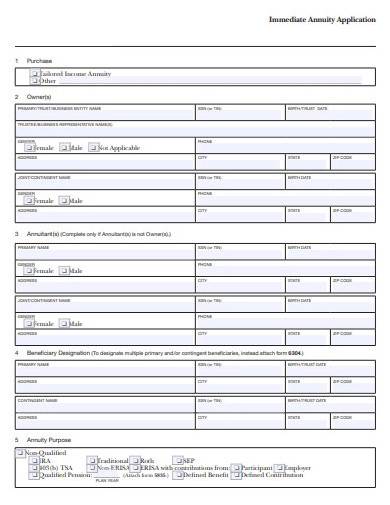

1. Immediate Annuity Application

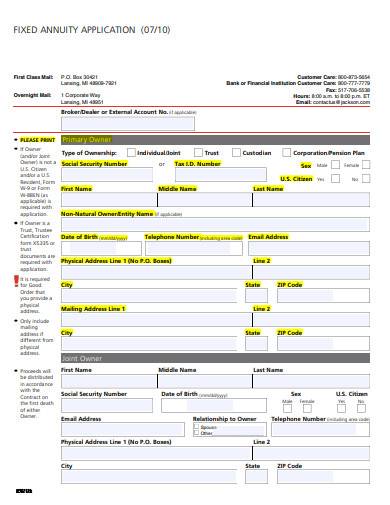

2. Fixed Annuity Application Template

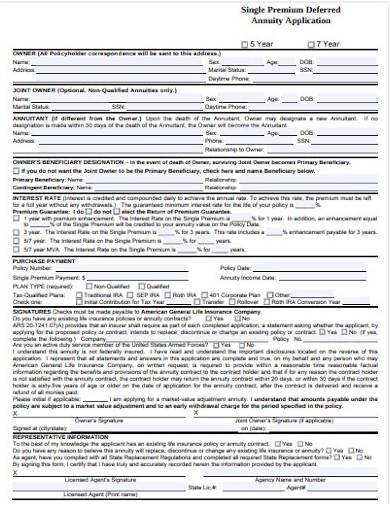

3. Single-Premium Deferred Annuity Application

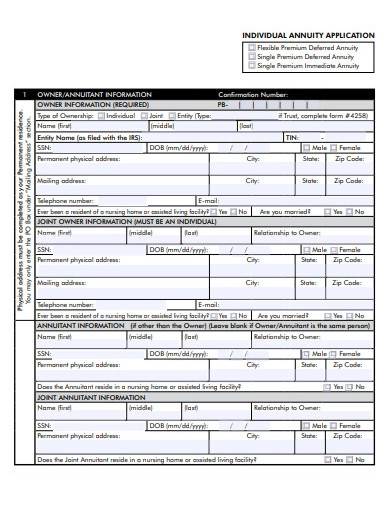

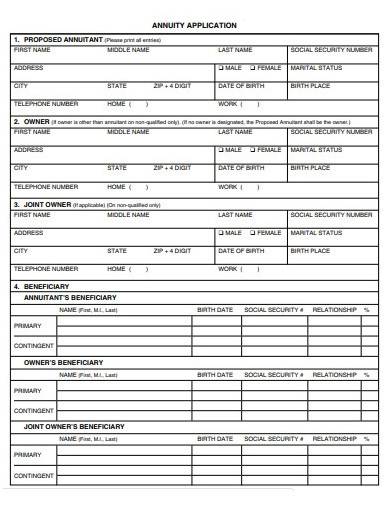

4. Individual Annuity Application Template

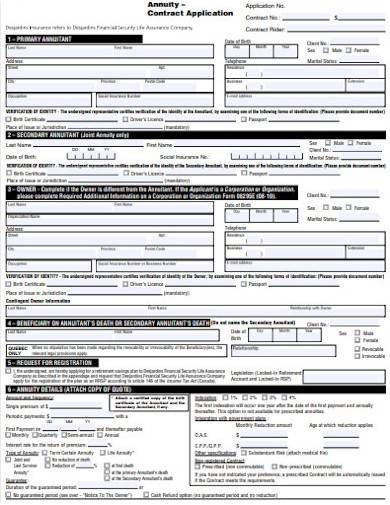

5. Annuity Contract Application Form

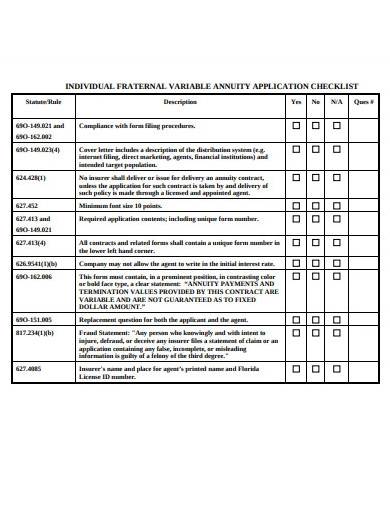

6. Individual Variable Annuity Application Checklist

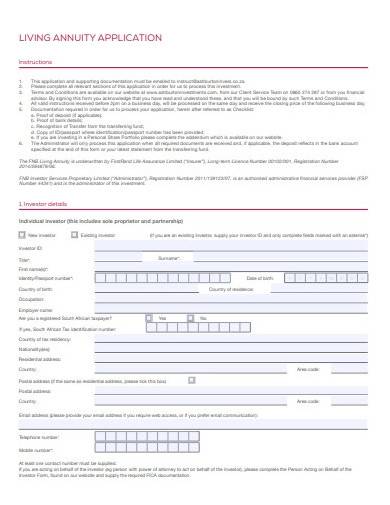

7. Living Annuity Application Example

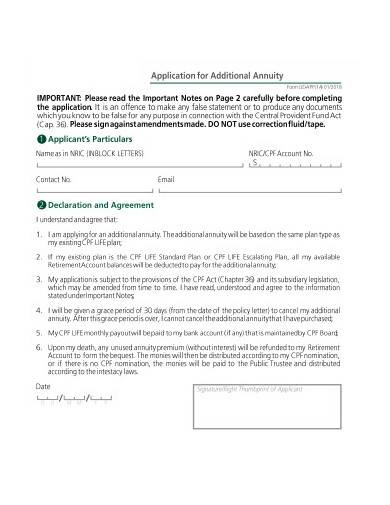

8. Application for Additional Annuity

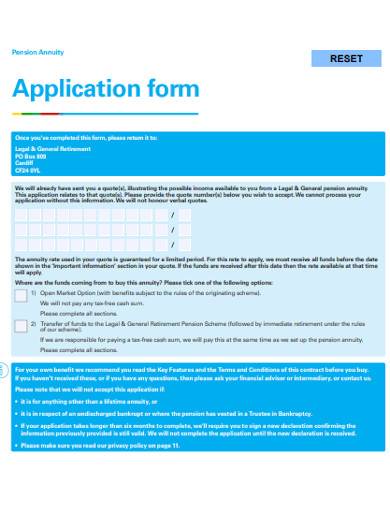

9. Pension Annuity Application Form

10. Format of Annuity Application Template

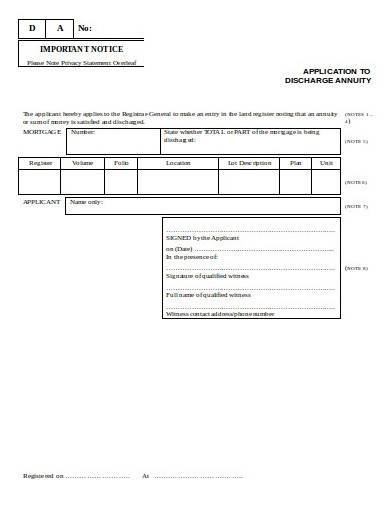

11. Application to Discharge Annuity

What is Annuity Application?

The procedure through which a person applies for an annuity, a financial product that offers a stream of consistent payments for a certain length of time, is known as an annuity application. Typically offered by insurance companies, annuities are intended to offer a reliable source of income during retirement. Choosing a payout option, paying the annuity, and submitting personal information like age, income, and health status are all commonly required throughout the annuity application process.

How To Make Annuity Application?

The type of annuity selected, the payout option chosen, and the funding amount will depend on the individual’s financial situation and retirement goals. It is important to understand the annuity application process and the different types of annuities available before making a decision. Working with a financial advisor can help ensure that the annuity selected is suitable for the individual’s needs and financial projection. Making an annuity application typically involves several steps:

Step 1- Determine the type of annuity

The first step is to decide on the type of annuity that is most suitable for your needs. There are two main types of annuities: fixed and variable. Fixed annuities provide a guaranteed rate of return, while variable annuities invest in the stock market analysis and offer the potential for higher returns, but with more risk.

Step 2- Gather personal information

You will need to provide personal information such as your age, income, and health status. This information is used to determine the payout amount and the length of the annuity. You will need to select a payout option, such as a single life option, which provides payments for the life of the individual, or a joint and survivor option, which provides payments for the life of the individual and their spouse.

Step 3- Choose the funding amount

You will need to decide how much you want to invest in the annuity. This can be done through a lump sum payment or through regular payments over a specified period. Once you have gathered all the necessary information, you can fill out the annuity application form provided by the insurance company.

Step 4- Submit the application

Once you have completed the application, you will need to submit it to the insurance company along with any required documentation. After the application is reviewed and approved, you will receive confirmation of the annuity contract, which outlines the payment terms of the annuity, including the payout amount and length of the annuity.

Who can apply for an annuity?

Anyone can apply for an annuity, but it is most common for individuals who are nearing retirement age and looking for a reliable source of income during retirement.

How long does the annuity application process take?

The length of the annuity application process can vary depending on the insurance company and the type of annuity you choose. Typically, the process can take several weeks to a few months.

Are there any fees associated with an annuity application?

There may be fees associated with an annuity application, such as administrative fees and sales charges. These fees can vary depending on the insurance company and the type of annuity you choose.

In conclusion, annuities can be a valuable financial product for individuals looking to supplement their retirement income. However, it is important to understand the application process and the different types of annuities available before making a decision. Working with a financial advisor can help ensure that the annuity selected is suitable for the individual’s needs and financial situation.

Related Posts

FREE 14+ Admission Application Samples in MS Word | Apple Pages | PDF

FREE 20+ University Application Samples in MS Word | Google Docs | PDF

FREE 29+ Student Application Form Samples in PDF | MS Word

FREE 21+ Administrative Application Samples in MS Word | Apple Pages | PDF

FREE 21+ Teacher Application Samples in MS Word | Apple Pages | Outlook | PDF

FREE 25+ Transfer Application Samples in MS Word | Apple Pages | PDF

FREE 23+ Participation Application Samples in MS Word | PDF

FREE 14+ Patient Application Samples in MS Word | PDF

FREE 21+ Eligibility Application Samples in PDF

FREE 20+ Travel Application Samples in PDF | MS Word

FREE 25+ Sponsor Application Sampales in MS Word | Google Docs | Apple Pages | PDF

FREE 23+ Candidate Application Samples in PDF

FREE 33+ Committee Application Samples in PDF | MS Word

FREE 37+ Supplemental Application Samples in PDF | MS Word

FREE 37+ Product Application Samples in PDF | MS Word