Liability insurance is an essential type of coverage for individuals and businesses alike. Accidents happen, and in today’s litigious society, even the most careful individuals or companies can find themselves facing a lawsuit. Liability insurance helps to protect against the financial consequences of these types of legal claims. Without liability insurance, individuals and businesses may be forced to pay out-of-pocket for legal fees, settlements, or judgments, which can be financially devastating.

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

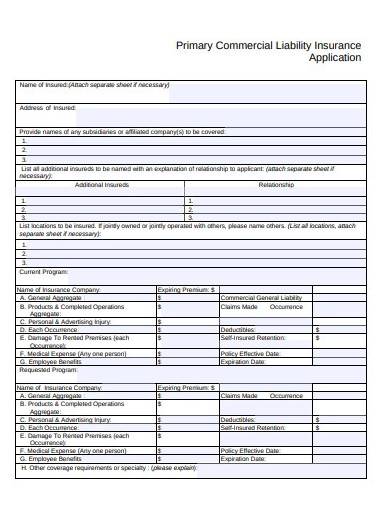

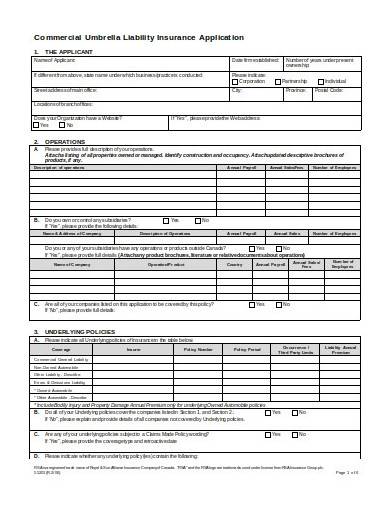

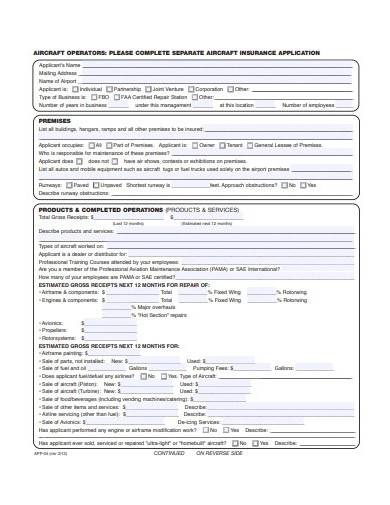

1. Primary Commercial Liability Insurance Application

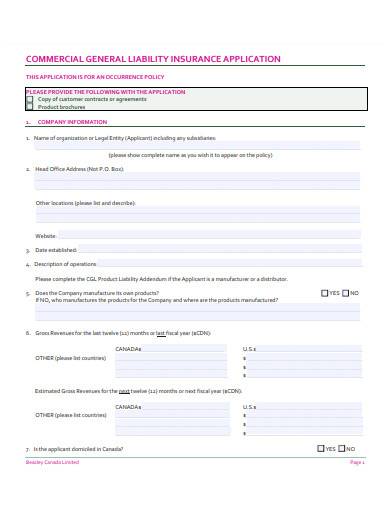

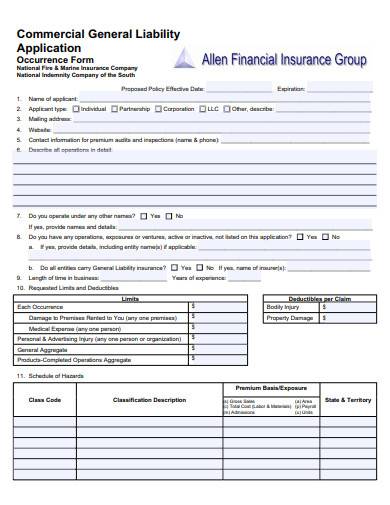

2. Commercial General Liability insurance application

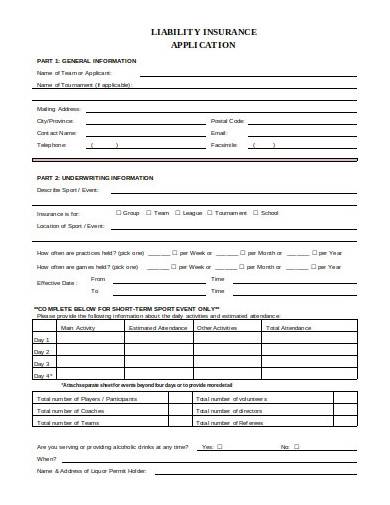

3. Sample Liability Insurance Application

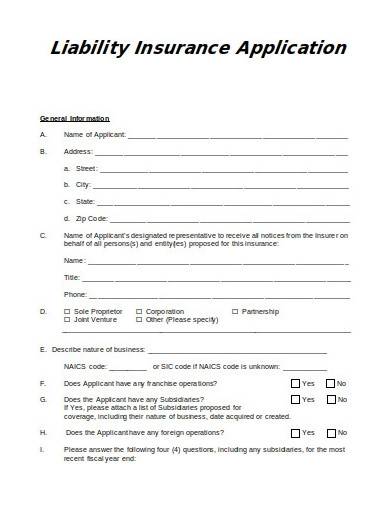

4. Liability Insurance Application Template

5. Commercial Liability Insurance Application

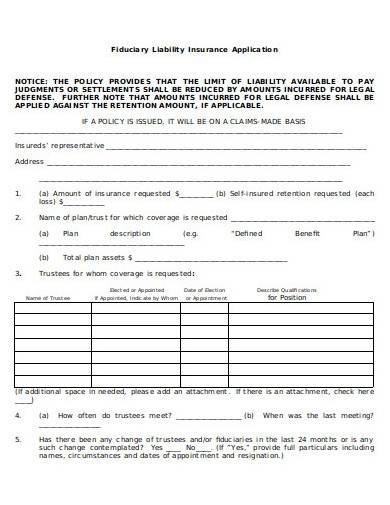

6. Fiduciary Liability Insurance Application

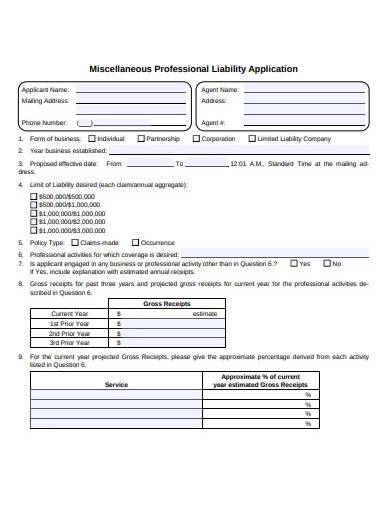

7. Miscellaneous Professional Liability Application

8. General Liability Application Template

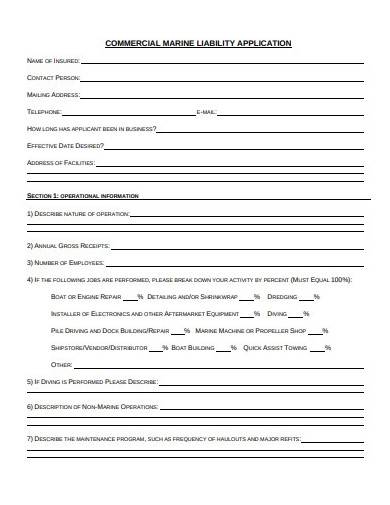

9. Sample Marine Liability Insurance Application

10. Simple General Liability Insurance Application

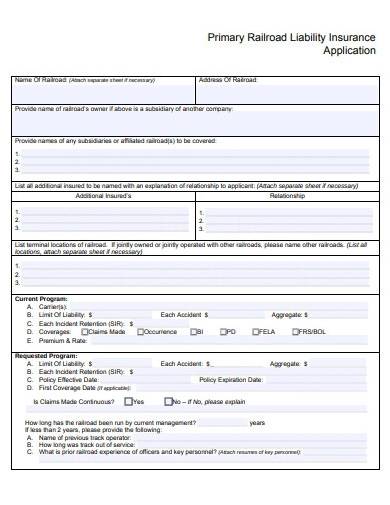

11. Railroad Liability Insurance Application

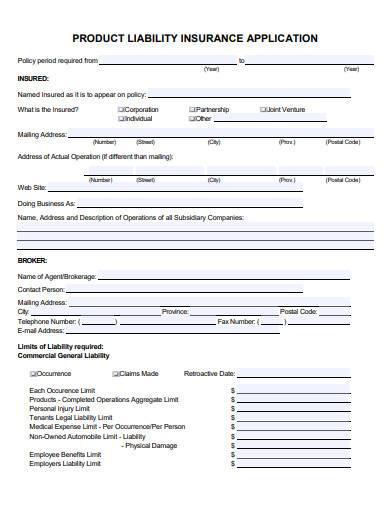

12. Product Liability Insurance Application

What is Liability Insurance Application?

Liability insurance is a type of insurance coverage that protects individuals and businesses against claims of negligence, injury, or property damage. Liability insurance applications are the forms that individuals or businesses must complete in order to apply for this important coverage. In this essay, we will explore the importance of liability insurance, the information required on liability insurance applications, and the benefits of obtaining liability insurance coverage.

How To Make Liability Insurance Application?

When completing a liability insurance application, individuals or businesses will be asked to provide a range of information about themselves, their activities, and the type of liability coverage they are seeking. Making a liability insurance application involves providing detailed information about yourself, your business, or your activities to an insurance company. Here are some steps to follow when making a liability insurance application:

Step 1- Determine the Liability Insurance Coverage

There are different types of liability insurance coverage available, such as general liability, professional liability, product liability, and more. Determine which type of coverage is most appropriate for your needs. Look for reputable insurance companies that offer liability insurance coverage. Consider factors such as their experience, customer service, and premium costs.

Step 2- Gather Necessary Information

To complete the liability insurance application, you will need to provide detailed information about yourself, your business, or your activities. This may include personal or business contact information, details about your activities, desired coverage limits, and information about any previous claims or lawsuits you have been involved in.

Step 3- Complete the Application

Once you have gathered all the necessary information, fill out the liability insurance application. Be sure to provide accurate and complete information to avoid any potential issues with the insurance coverage. Submit the completed application to the insurance company either online or by mail. Some insurance companies may require additional documentation or information, so be prepared to provide this if necessary.

Step 4- Wait for Approval

The insurance company will evaluate your application and determine whether to approve your coverage. This process may take some time, so be patient and follow up with the insurance company if necessary.

Who needs liability insurance?

Anyone who could potentially face a lawsuit as a result of their actions or activities should consider obtaining liability insurance coverage. This includes individuals and businesses of all sizes and types.

What types of liability insurance are available?

There are different types of liability insurance coverage available, such as general liability, professional liability, product liability, and more. The type of coverage you need will depend on the nature of your activities and the types of risks you face.

How can I find liability insurance coverage?

You can find liability insurance coverage by researching reputable insurance companies and comparing their offerings. You may also want to consult with an insurance agent or broker to help you identify the right type and amount of coverage for your needs.

In conclusion, liability insurance is an essential type of coverage for individuals and businesses. Liability insurance applications provide insurance companies with the information they need to evaluate risk and determine appropriate premiums for coverage. Obtaining liability insurance coverage can provide financial protection, enhance your reputation and credibility, and give you peace of mind knowing that you are protected against the financial consequences of a lawsuit.

Related Posts

FREE 17+ Referral Application Samples in MS Word | PDF

FREE 14+ Admission Application Samples in MS Word | Apple Pages | PDF

FREE 20+ University Application Samples in MS Word | Google Docs | PDF

FREE 29+ Student Application Form Samples in PDF | MS Word

FREE 21+ Administrative Application Samples in MS Word | Apple Pages | PDF

FREE 21+ Teacher Application Samples in MS Word | Apple Pages | Outlook | PDF

FREE 25+ Transfer Application Samples in MS Word | Apple Pages | PDF

FREE 23+ Participation Application Samples in MS Word | PDF

FREE 14+ Patient Application Samples in MS Word | PDF

FREE 21+ Eligibility Application Samples in PDF

FREE 20+ Travel Application Samples in PDF | MS Word

FREE 25+ Sponsor Application Sampales in MS Word | Google Docs | Apple Pages | PDF

FREE 23+ Candidate Application Samples in PDF

FREE 33+ Committee Application Samples in PDF | MS Word

FREE 37+ Supplemental Application Samples in PDF | MS Word